John Goff has decades of experience in buying distressed assets. First real estate, now oil.

Tim Pannell/The Forbes Collection

For the past two years Fort Worth billionaire John Goff has been busy bottom feeding. As low commodity prices crushed overextended oil companies, his publicly traded Contango Oil & Gas has invested hundreds of millions to snap up some 400,000 acres of drillable acreage in Texas, Oklahoma and Wyoming, and now produces about 25,000 barrels of oil and gas per day. As Goff told Forbes for a profile earlier this year, “Oil and gas is going to come back with a vengeance.” And so it has, hitting $70 per barrel on Monday for the first time in years.

Today Goff announced his biggest oil deal yet—a $5.7 billion all-stock merger between Contango and Independence Energy, owned by private equity giant KKR

KKR

Although shares in Contango have doubled this year, this is not a case of Goff looking to cash out. On the contrary, says Goff (in an interview this morning), they intend a build a platform for consolidating weaker hands from among the horde of overleveraged frackers. “I am very bullish on the opportunity and a long-term investor in this business,” he says.

KKR’s David Rockecharlie, head of the private equity giant’s “Energy Real Assets” division explained today that Independence will be contributing years’ worth of accumulated oil and gas assets to the new Contango. That includes stakes in oilfields that KKR has developed over the past six years in partnership with the likes of Venado Oil & Gas (in the Eagle Ford) and Fleur de Lis Energy (in Wyoming and the Permian).

KKR has long been a player in the oil sector. Cofounding billionaire Henry Kravis (a friend of Goff) hails from oil town Tulsa, Oklahoma. In 2011 KKR even acquired Tulsa’s Samson Resources from the Schusterman family for $7.2 billion. Unfortunately, KKR overpaid. Burdened with too much debt, Samson went bankrupt a few years later. Rockecharlie arrived at KKR after the Samson deal was done, but he was involved in getting Samson through Chapter 11 and building a portfolio of cash-generating oil and gas assets.

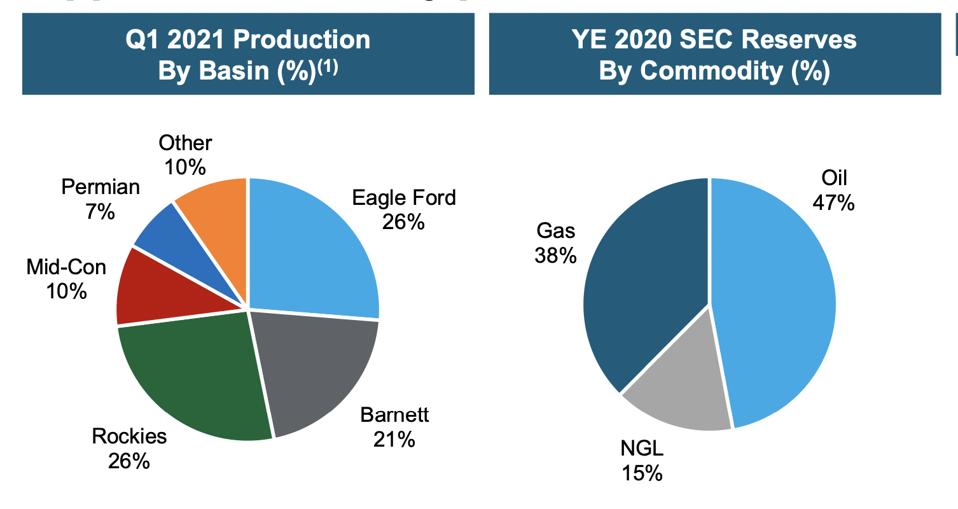

It’s unclear whether the new Contango will inherit any of those legacy-Samson assets. According to today’s deal presentation, the pro forma company will derive (a surprisingly high) 21% of its output from the Barnett Shale gas region around Fort Worth, 7% from the Permian and 26% the Eagle Ford, where they have several hundred drilling locations. The company will have roughly $900 million of debt outstanding—a relatively low amount of leverage relative to peers. Ebitda is forecast at $750 million.

KKR will hold 17% of the new Contango on its balance sheet with another—50% of the equity held in funds such as KKR Energy Income and Growth Fund I.

Pro forma new Contango production and reserve characteristics.

Contango investor presentation.

Goff and Rockecharlie are enthused that having larger scale and a bigger public float will make for more flexible access to capital. “This is happening at a time when there is a lot of stranded assets,” says Rockecharlie. Companies “may have gotten a bailout, but are not sure what to do.” His implication: They should sell—to him.

There is a sense that KKR and Goff are creating what one oil patch observer this morning described to me as a “SmashCo”—a kind of smorgasbord assemblage of disparate assets that weren’t catching a bid elsewhere. That’s a good term, but might be unfair. Goff insists that current oil prices will be extremely lucrative for the new Contango, which will have a number of core subsidiaries—with Contango’s existing management team continuing to operate their legacy assets.

It’s far from Goff’s first rodeo. In the 1990s Goff and his mentor, the late Fort Worth investing legend Richard Rainwater, bought up office buildings in the wake of the S&L crisis for pennies on the dollar. At own point Rainwater ordered Goff to look into buying the entire distressed real estate portfolio of the federal Depository Trust Co. They ultimately sold Crescent Real Estate for $6.5 billion at the 2007 peak. Goff raised funds to buy Crescent back at a deep discount after the Great Recession. Among other assets, Goff owns the Canyon Ranch resort chain and the Ritz-Carlton, Dallas. All told, Crescent, which he chairs, manages more than $3 billion in assets.

It’s fun buying distressed assets, when you believe, like Goff does, in the long-term staying power of petroleum. “We have a clear shot at doubling the size of the combined company again, in a short period of time,” he says.

/https://specials-images.forbesimg.com/imageserve/60bfab3bcdf68f2fc49b077b/0x0.jpg?cropX1=22&cropX2=933&cropY1=73&cropY2=679)