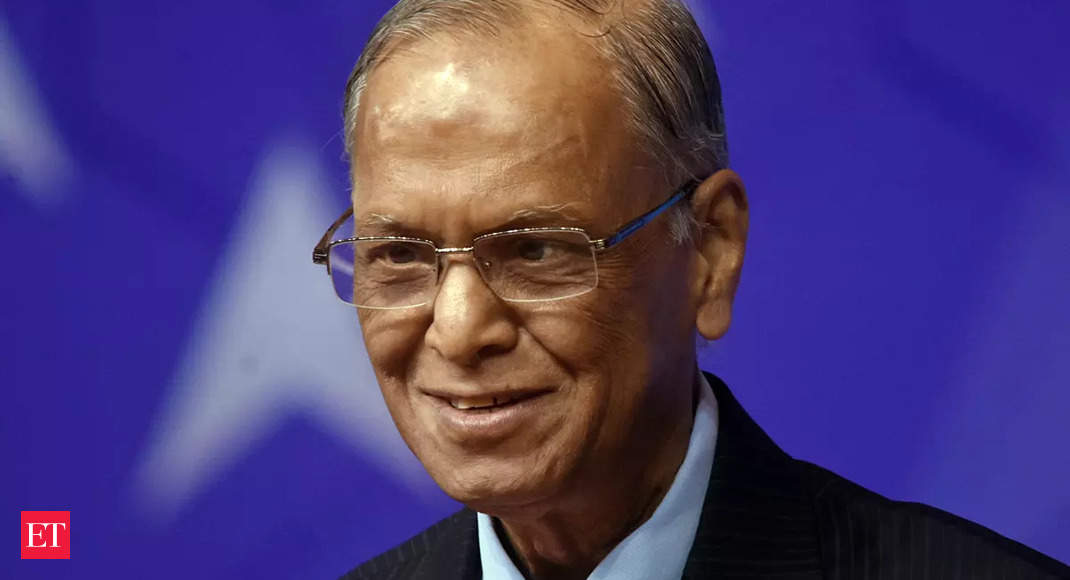

But Murthy made an even keener point a week earlier at a Symbiosis International University event in Pune. Without mincing words, he said, ‘One of the lacunae in India at this point of time is that we don’t not have a company that specialises in quality market research. This, poor quality market research, in his reckoning, has led to overestimation of market size by unicorns, leading to huge losses. On this one, Murthy may have caught the unicorn by the wrong horn.

Over the last four decades, I’ve had the good fortune of working with some of the best marketing research (MR) brains of this country. They are as good as the best in the world. In fact, many global MR firms use India as a talent pool. At one time, almost all MR companies in the Far East, including China, were headed by Indian talent. Also, companies like Unilever and Procter & Gamble have tapped their Indian arms for MR talent.

If such is the case, what’s with unicorns? Any self-respecting MR professional will tell you that it all starts with the brief – the better the brief, the better the research outcome. Sometimes, the brief almost dictates the outcome with a bit of a ‘nudge-nudge, wink-wink’. MR firms are then made to present their numbers. Better firms always add a qualifier or two, stating critical assumptions like, ‘The estimate is based on tapping the tier-3 market’, ‘The estimate assumes universal distribution,’ etc.

Seasoned marketers know that asking consumers their ‘intention to buy’ to do a market estimation is always fraught with danger. Some reasons:

‘Intention to purchase’ (ITP) is not real purchase. Some MR firms create mock stores to move this closer to reality.

ITP assumes that the product or service is going to be available everywhere. ITP is a measure that is taken at one point of time. This may not be the same a few months later.

All quantitative research needs to be done with samples that are reflective of the general population and have to be large enough to undergo statistical validity tests.

When we get ITP scores of 80%, we know it is not really 80%. This could be 40%, or even 20%. Most companies have historical data about what happened in the past. MR firms, too, can help bridge the gap between ‘intention’ and ‘reality’.

It is likely that the unicorns that Murthy is referring to want to see the ‘80%’ as 80%. Overambitious VCs may even ask ‘Why only 80%? Why not 90%?!’ That may be a big problem, too.

That said, global MR firms are represented in India. Some of them have arms dedicated to working on global research projects. Many of them have also been able to adapt to the changing technology and digital landscape. If I have a bone to pick, it is that MR firms have not done a good job of evangelising their profession. They also tend to undersell their services and value they bring to the board room.

As for unicorns, I wonder how many of them consider MR as a critical activity that needs to be done with the help of an independent-minded professional services firm. And unicorns can also do with some serious reorientation on what consumer research actually is, starting with how to prepare a research brief and interpret the results.

Better MR can be a help in all situations. But be warned. It is truly very difficult to predict the market response to technological breakthrough products. Segway, Tivo, Apple Newton all launched with huge fanfare, set to become blockbuster products. They all vanished without a trace. Was market research to blame? I don’t think so.