By Nick Edser, Business reporter

Getty Images

Getty ImagesThe UK economy grew faster than expected in May helped by a strong performance from retailers and the construction industry.

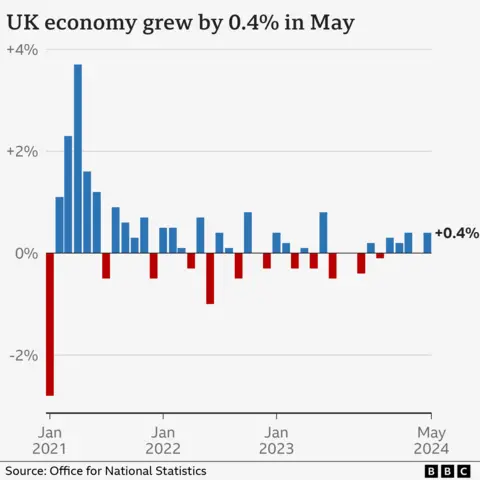

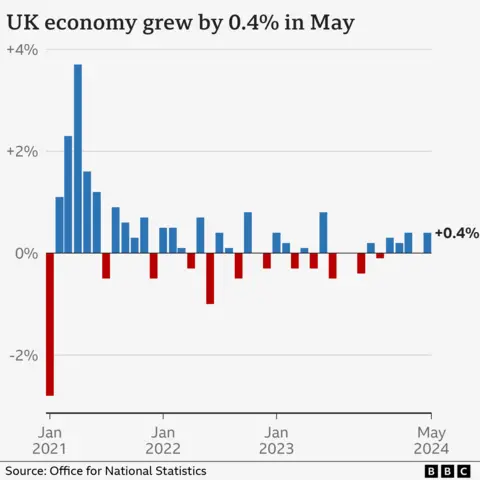

The economy expanded by 0.4%, rebounding from zero growth in April when wet weather put off shoppers and slowed down building projects.

Construction grew at the fastest rate in almost a year in May, with house building and infrastructure projects boosting the industry, the Office for National Statistics (ONS) said.

Analysts said the new figures, together with recent comments from Bank of England policymakers, meant the decision on whether interest rates will be cut next month was on a “knife-edge”.

May’s growth figure was double what was expected. Liz McKeown, of the ONS, said that many retailers and wholesalers “had a good month, with both bouncing back from a weak April”.

The services sector, which dominates the UK economy and covers businesses such as shops, bars and restaurants, grew by 0.3% in May, while the construction sector jumped by 1.9%.

The question of how to increase growth in the UK’s economy was one of the key battlegrounds in the recent general election.

Responding to the latest growth figures, Chancellor Rachel Reeves said economic growth was the government’s “national mission”, and “that is why this week I have already taken the urgent action necessary to fix the foundations of our economy”.

On Monday, Ms Reeves said housebuilding targets would be reintroduced, planning restrictions would be overhauled and there would be an end to the effective ban on onshore wind farms in England.

A new National Wealth Fund has also been announced to attract investment in infrastructure and green industry.

The shadow Chief Secretary to the Treasury, Laura Trott said the latest economy figures “show that the steps we put in place whilst in government have strengthened the economy”.

“These figures also prove Labour are inheriting an economy turning a corner, after the many difficult decisions we took in government,” she added.

‘People want to get out and about again’

Carrie-Anne Moore runs alternative store Broken Bonds in Digbeth indoor market in Birmingham where she says business is booming.

“I started quite small and over the last six months it has grown quite substantially from a small unit to a big unit to a second spot so for me it’s been pretty good,” she said.

As well as her space in Digbeth Ms Moore also sells at markets and tattoo conventions.

“I think now people want to get out and about again, they don’t want to shop online,” Ms Moore added.

“They want a more personable experience in shopping rather than just that faceless big corporation.”

However, things are not going so smoothly for Mark Preston, who runs Ideal Skateboard in Digbeth.

“It’s been a very difficult spring… nobody’s really been coming out and buying stuff because the weather’s been terrible,” he said.

“Skateboarding is an outdoor sport so when it’s wet, people just aren’t out doing it. And so if they’re not doing it, they’re not buying more products.”

Economists warn against placing too much weight on shifts in economic activity over one month because they can be affected by factors such as the weather.

In the three months to May 2024, the economy grew by 0.9% compared with the previous three months, which the ONS said was the quickest pace for more than two years.

Analysts said the surprisingly strong growth figures could reduce the chances of the Bank of England cutting interest rates from the 16-year high of 5.25% when it meets on 1 August.

Interest rates were increased by the Bank in order to slow the pace of inflation – the rate at which prices rise. However, the latest inflation figures showed the rate had fallen back to the Bank’s target of 2%.

Despite this, two members of the Bank’s Monetary Policy Committee (MPC), which decides the level of interest rates, have said this week they remain worried that inflationary pressures are persisting.

“This snapshot of an economy growing a bit faster than forecast, could make Bank of England policymakers that bit more reticent about voting for an interest rate cut,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

“The possibility of a summer rate cut is fading, with a vote on 1 August expected to be on a knife-edge.”

Rob Wood, chief UK economist at Pantheon Macroeconomics, said: “The UK economy is well and truly putting last year’s minor recession behind it.

“Rate-setters look desperate to ease policy and said in the minutes of their June meeting that they were unconcerned about stronger-than-expected growth,” he added.

“Even so, this latest upside growth surprise supports our call that the MPC will wait until September to reduce Bank Rate.”