The head of the US central bank has said “the time has come” for officials to cut interest rates, but he offered few clues as to how quickly or how far borrowing costs might come down.

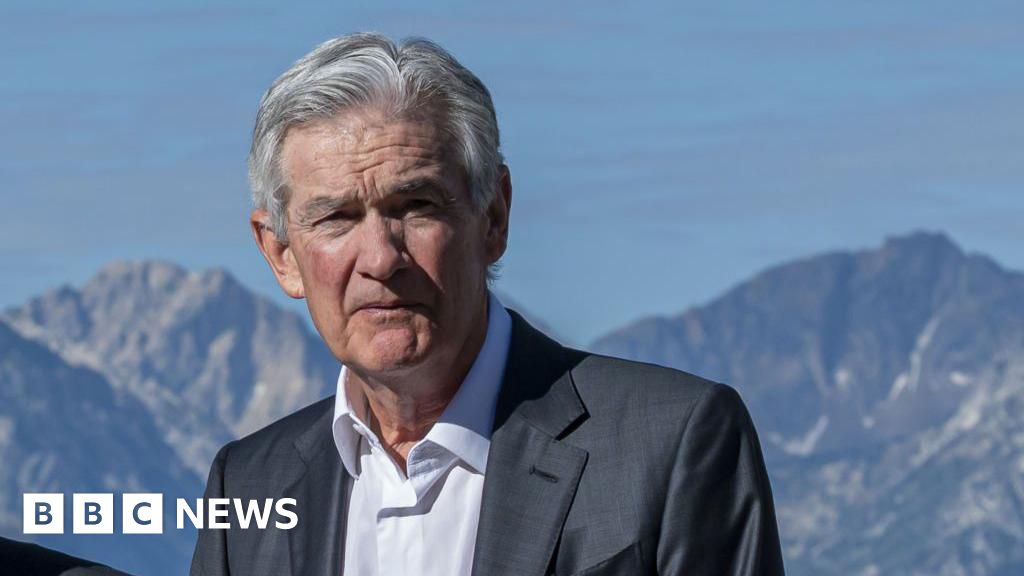

The speech from Federal Reserve chairman Jerome Powell was being closely watched, as rising unemployment has revived concerns about how the US economy is holding up under higher interest rates.

Mr Powell said the bank was increasingly focused on the job market, as it gains confidence that the US was moving past the surging prices that started during the pandemic.

Inflation, which tracks the pace of price rises, fell to 2.9% in the US last month, its lowest rate since March 2021.

“The time has come for policy to adjust,” Mr Powell said, speaking from a conference in Jackson Hole, Wyoming, while adding that the timing and pace of cuts would depend on data.

The remarks signalled the start of a new fight for the Fed, after more than two years focused on stabilising prices.

In his own speech on Friday, Bank of England Governor Andrew Bailey said it was “too early” to declare victory over inflation in the UK, despite the Bank’s decision to cut rates at its most recent meeting.

“We need to be cautious because the job is not completed – we are not yet back to target on a sustained basis,” he said. “The course will therefore be a steady one.”

In the US, the Fed has kept its key lending rate at roughly 5.3% – a two-decade high – since last July, holding off on cuts pursued by central banks in other countries, including the UK.

Mr Powell has argued the US economy was healthy enough to handle the high interest rates, pointing to a steady streak of job gains, which has helped households weather the jump in prices and uptick in borrowing costs.

But those gains have slowed significantly since last year and the jobless rate has ticked up to 4.3%, reviving fears that the Fed’s policies will knock the expansion off course and throw millions of people out of work.

The US has experienced economic recession after most of the Fed’s previous rate-rising campaigns.

In his speech, Mr Powell acknowledged a significant slowdown in the job market, saying the Fed did not “seek or welcome further cooling”.

But he pushed back against concerns about another recession in the near future, arguing that the rise in unemployment was consistent with a slowdown in hiring, not a sudden spike in job cuts.

“There is good reason to think that the economy will get back to 2% inflation while maintaining a strong labour market,” he said, adding later that the “pandemic economy” had proven to be “unlike any other”.

Stock markets rose after Mr Powell’s comments, which sent the Dow, S&P 500 and Nasdaq all up more than 0.5%.

Analysts said the speech had made it all but certain that the bank would cut rates by at least 0.25 percentage points at its meeting next month as is currently expected – or perhaps by more.

“The lack of any guidance suggests that Powell is keeping his options open,” said Stephen Brown, deputy chief North American economist at Capital Economics, after the speech.