Britain’s Prime Minister Boris Johnson (L) is shown around by company founder Matthew Moulding

Getty Images

Matt Moulding, founder of U.K. e-commerce and technology giant The Hut Group (THG), has become the latest U.K. retail billionaire following the company’s successful IPO on the London Stock Exchange.

The Hut Group began trading on Wednesday morning, at an offer price of 600 Pence per share, which valued the company at $5.8 billion (£4.5 billion). Since then, shares have risen to 625 Pence, lifting The Hut Group’s market cap to over $6 billion.

Moulding owns 25% of the company, which he founded in 2004. He built up The Hut Group by spending £500,000 in 2009 to buy the remnants of retail chain Zaavi.co.uk. Moulding’s 25% stake in The Hut Group is worth $1.5 billion at the close of market Wednesday.

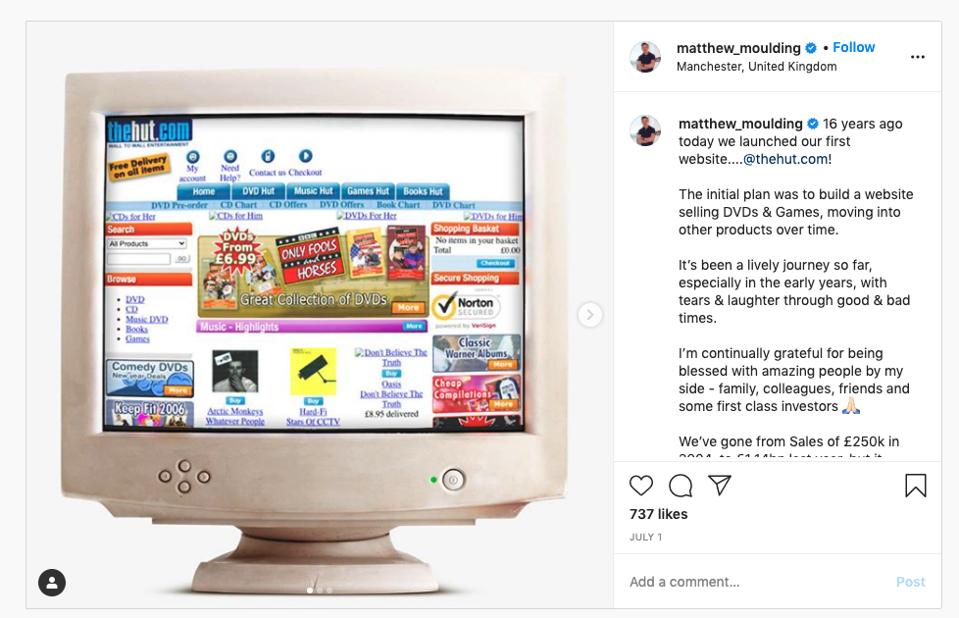

The first THG website back in 2004

@Matthew_Moulding

The group runs over 150 mobile-friendly websites from fashion to nutrition and beauty suppliers, offering next-day delivery to U.K. customers and selling across 164 countries in total. Its most profitable, according to a group source, are My Protein, which serves a fitness and bodybuilding clientele, and Look Fantastic, which offers brand name and own-brand beauty products.

Last year THG generated sales of $1.48 billion—up 24% from the year prior—with profits of $144 million (£111m), up from $118 million the previous year. The company, which employs around 7,000 people, has been pushing into the manufacturing of beauty and health products following the purchase of a number of players in the industry, including premium British beauty brand Acheson & Acheson in 2018.

But much of the profit comes from licensing its technology, described in its annual report as software for the “entire customer journey” from the making of beauty products through to delivery. THG has partnerships with a growing list of retailers that include Walgreens

WBA

PG

JNJ

A man stands outside the London Stock Exchange in London

Xinhua News Agency/Getty Images

First Million To First Billion

Moulding was born in Lancashire in the north of England, the son of a tarmac contractor father and antiques trader mother, according to the Times. He studied industrial economics at the University of Nottingham and qualified as a chartered accountant.

In the early 2000s Moulding worked alongside fellow Forbes billionaire John Caudwell at mobile phone retailer Phones4U, where he says he first saw the potential in online retailing and learnt the nuts and bolts of supply-chains, storage and shipping as finance director of the distribution division.

In 2006, when Caudwell sold Phones4U for $2.8 billion, Moulding landed the “couple of million” he needed to develop his online proposition, he told the Times in July 2019. In 2009, THG went big after buying CD and DVD chain Zavvi, formerly Virgin Megastores, out of bankruptcy. After realizing that Amazon

AMZN

The pivot to developing his own tech came in the early days for Moulding, who told the London Stock Exchange that THG first launched using “someone else’s technology”, but realized within three weeks that the model wouldn’t work. “We took on two developers – with money I barely had – and built our own platform,” he told the LSE. “As soon as we did so, our sales doubled.” Today, Moulding adds, THG builds everything in-house.“This drives the DNA of the business,” he says. “And it all started with those two developers – one of them is still with us today.”

Politics

In April, near the start of the pandemic, the group announced it would make $13 million (£10 million) worth of support to help in the battle against coronavirus. A $1.3 million cash donation was earmarked for Manchester’s needs with $5.1 million sent for critical products and services to help the NHS and those most vulnerable in the region. A further $6.4 million of aid was pledged by THG to areas outside of the North West, including international markets.

Moulding told the BBC that THG wanted to “support vulnerable communities, key workers and the emergency services.”

Moulding describes the THG, one of a small number of tech companies to emerge in the U.K. from outside of London, as a “proudly Mancunian business.” As a rare northern unicorn, THG attracted the attention of Prime Minister Boris Johnson, who was keen to be seen at the group’s warehouse in the days before the 2019 general election, where he packed boxes without making a statement.

The focus on THG has shifted from Downing Street to the stock exchange, with shareholders reaping the rewards of a successful IPO—none more than THG’s newly-minted billionaire founder. Other winners from today include KKR

KKR

/https://specials-images.forbesimg.com/imageserve/5f63195503da45069b063111/0x0.jpg?cropX1=1382&cropX2=3662&cropY1=461&cropY2=1744)