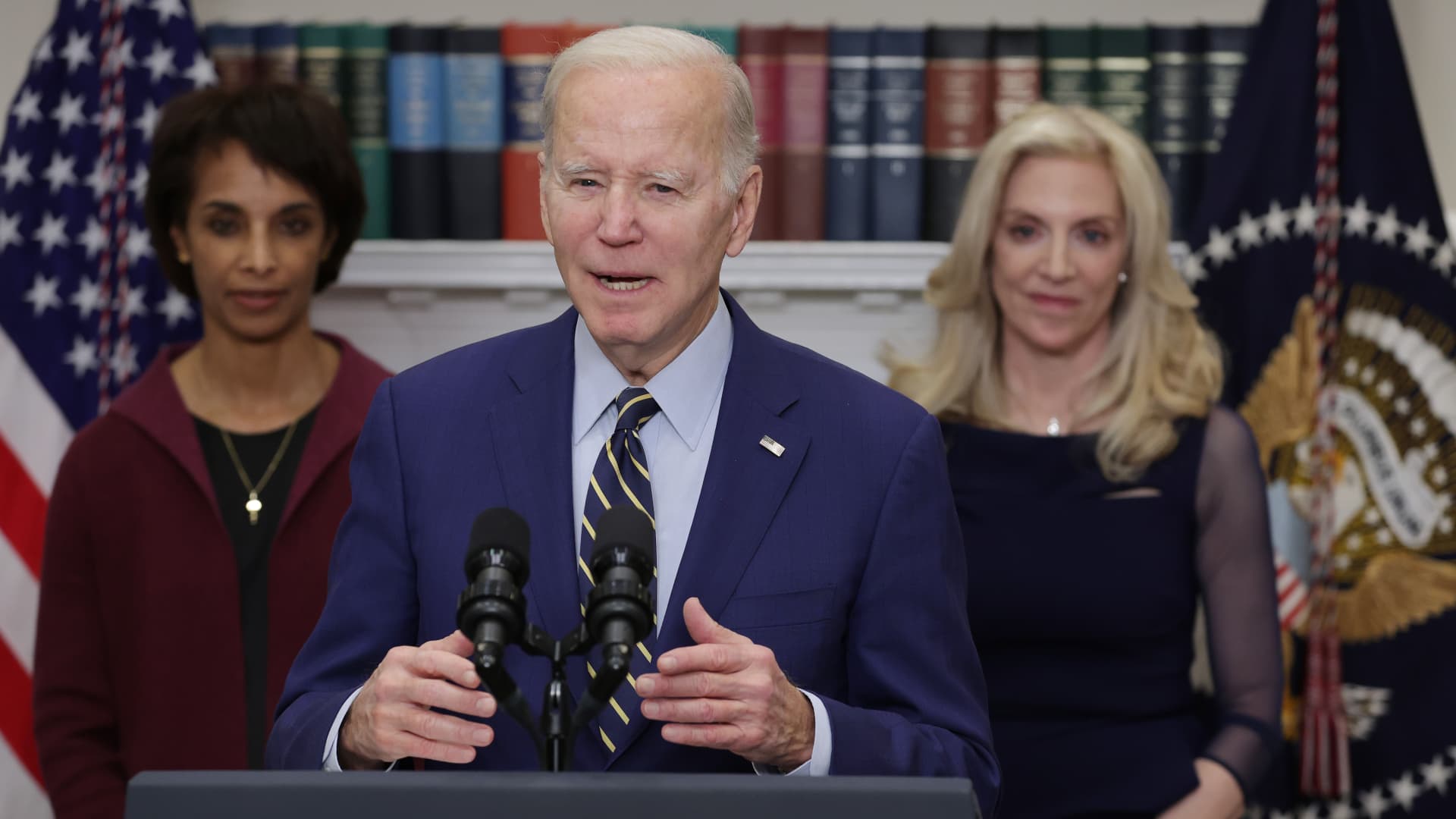

U.S. President Joe Biden (C) delivers remarks on the February jobs report with Council of Economic Advisers Chair Cecilia Rouse (L) and National Economic Council Director Lael Brained in the Roosevelt Room at the White House on March 10, 2023 in Washington, DC.

Alex Wong | Getty Images News | Getty Images

President Joe Biden released his 2024 budget plan Thursday that promises to cut the deficit by $3 trillion over the next decade thanks to a flurry of new and increased taxes aimed at the richest Americans.

The proposal is merely the first step in the federal government’s budgetary process and is unlikely to be enacted in its current form facing a divided Congress now that Republicans hold the majority in the House of Representatives.

Many of the proposed taxes are more of messaging signals as the president prepares to launch a potential re-election bid and enter the 2024 campaign season.

Where is the money coming from? Here’s a look at the greatest revenue-earning taxes outlined in the plan.

All revenue numbers are over the span of the next decade.

Raise corporate tax rate to 28%: $1.326 trillion

Biden’s budget calls for increasing the corporate income tax to 28% from the current 21%. The White House argues the increase is still far below the 35% tax before former President Donald Trump slashed the tax in 2017.

Ensuring companies “pay their fair share” has been a priority for Biden since his campaign and is likely to take center stage on his platform if he decides to run again. The president’s economic platform is centered on building the economy “from the bottom up and middle out” a direct criticism of so-called “trickle-down economics” theories. Increasing taxes on the highest earners, including large corporations, is central to its implementation.

Impose minimum income tax on 0.01%: $436.61 billion

Biden’s budget calls for a minimum 25% tax on American households worth over $100 million, which would more than triple the 8% rate the wealthiest 0.01% currently pay.

“No billionaire should be paying a lower tax rate than a school teacher or a firefighter,” Biden said in a speech Thursday in Philadelphia, Pa. after his budget proposal was released. He said there are more than a thousand billionaires in the United States currently, up from 600 when he took office two years ago. Those Americans, the White House argues, should be contributing more.

Read more on Biden’s fiscal year 2024 budget plan:

Increase the wealthy’s ACA tax: $344.37 billion

Biden’s budget calls for increasing the 3.8% Affordable Care Act tax to 5% on Americans earning more than $400,000. The increase would go towards bolstering Medicare.

Close ACA tax loopholes: $305.94 billion

This is another reform that would help shore up Medicare. If enacted, it would close the loophole to ensure the Obamacare tax is always applied to high earners’ so-called “pass-through businesses” where income flows to individual returns.

Increase top marginal income tax: $235.26 billion

Building off of the billionaires’ tax, Biden’s budget outlines bumping the top payroll tax rate to 39.6%, up from 37%, on Americans making more than $400,000 annually and married couples earning more than $450,000 a year. If enacted, the income tax hike would reverse cuts made by former President Donald Trump in his 2017 tax bill.

Quadruple the stock buyback tax: $237.91 billion

The new levy placing a 1% tax on all stock buybacks was passed under last year’s Inflation Reduction Act and went into effect on Jan.1. It is projected to garner $74 billion over the next ten years. The president though argues it doesn’t go far enough to curb share repurchases and proposed in his budget increasing the tax four-fold to 4%. The move, the White House states, would encourage investment in businesses themselves rather than share repurchases and dividends.