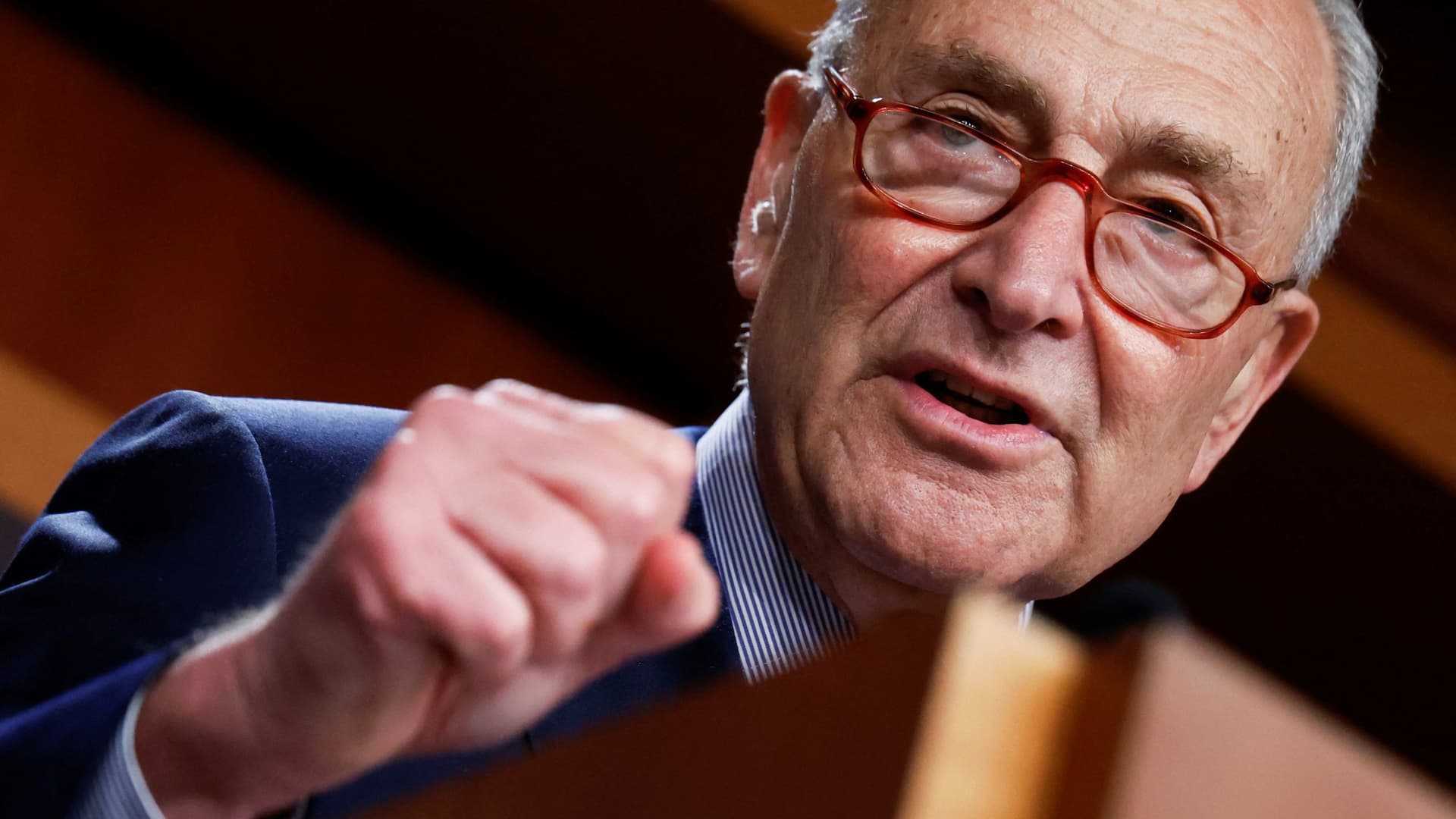

U.S. Senate Majority Leader Chuck Schumer (D-NY) holds his weekly news conference after the Democratic caucus party luncheon at the U.S. Capitol in Washington, August 2, 2022.

Jonathan Ernst | Reuters

Senate Majority Leader Chuck Schumer said Friday that Democrats had “no choice” but to drop a key tax provision from their major spending bill in order to gain Sen. Kyrsten Sinema’s support.

Sinema, a centrist Democrat from Arizona, had withheld her support of the Inflation Reduction Act, the sweeping bill that includes much of the Biden administration’s tax, climate and health care agenda. Senate Democrats need her support to pass the bill through the Senate on a party-line vote using the budget reconciliation process, which requires a simple majority vote. The chamber is split 50-50 between Democrats and Republicans.

Sinema announced Thursday night that she would indeed back the legislation, following an agreement “to remove the carried interest tax provision.”

She was referring to the bill’s inclusion of language that would narrow the so-called carried interest loophole, a feature of the tax code that both Democrats and Republicans — including former President Donald Trump — have tried to close.

Carried interest refers to compensation that hedge fund managers and private equity executives receive from their firms’ investment gains. After three years, that money is taxed at a long-term capital gains rate of 20%, instead of a short-term capital gains rate, which tops out at 37%.

The Inflation Reduction Act aimed to narrow that loophole by extending the short-term tax rate to five years. The bill’s provision was projected to raise $14 billion over a 10-year period.

“I pushed for it to be in this bill,” Schumer, D-N.Y., said of the proposal to narrow the loophole.

But “Senator Sinema said she would not vote for the bill, not even move to proceed unless we took it out,” he said. “So we had no choice.”

Sinema stressed Thursday night that after the reconciliation bill passes, “I look forward to working with [Sen. Mark Warner, D-Va.] to enact carried interest tax reforms, protecting investments in America’s economy and encouraging continued growth while closing the most egregious loopholes that some abuse to avoid paying taxes.”

A spokeswoman for Sinema defended the senator’s record when asked by CNBC on Friday about Schumer’s remarks and her stance on carried interest.

Sinema “has been clear and consistent for over a year that she will only support tax reforms and revenue options that support Arizona’s economic growth and competitiveness,” the spokeswoman said. “At a time of record inflation, rising interest rates and slowing economic growth, disincentivizing investments in Arizona businesses would hurt Arizona’s economy and ability to create jobs.”

Schumer said that another tax piece from the Inflation Reduction Act was taken out in order to secure the deal with Sinema. This one came from a proposal to impose a 15% corporate alternative minimum tax aimed at rich corporations that are accused of skirting their tax obligations. It was projected to raise $313 billion — more than 40% of the bill’s revenue.

While that part of the bill was altered, “$258 billion of that remains, so the vast majority remains,” Schumer said.

And while the carried interest provision was nixed, Schumer said Democrats added in an excise tax on stock buybacks that will bring in $74 billion. He said that multiple legislators are “excited” about that update.

“I hate stock buybacks. I think they’re one of the most self-serving things corporate America does,” Schumer said. “I’d like to abolish them.”