Nvidia shares opened up more than 12% Thursday morning, a day after the chipmaker reported a beat on the top and bottom line. Analysts are also bullish on the company’s AI vision.

Nvidia reported $6.05 billion in revenue for the fiscal fourth quarter and adjusted EPS of 88 cents, edging out the Wall Street consensus. It forecast $6.5 billion in sales for the upcoming quarter.

Analysts responded positively both to Nvidia’s results and to growth in its data center business, with a slew of reiterated or upgraded ratings coming after the report. That vertical is home to most of Nvidia’s sales of GPUs for artificial intelligence and grew 11% year over year.

More than a dozen analysts hiked their target prices or held a positive rating on the stock.

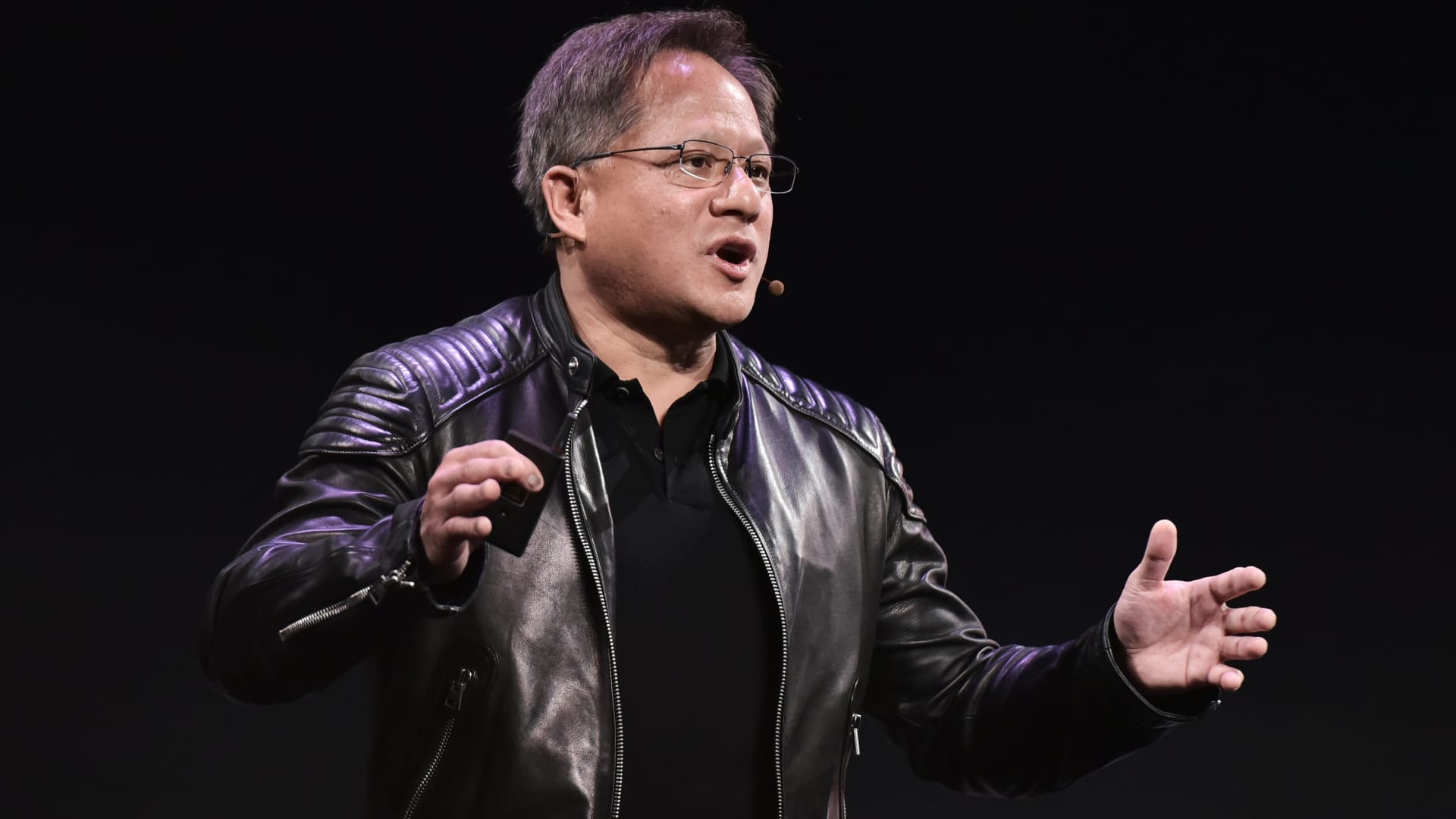

“AI adoption is at an inflection point. OpenAI’s ChatGPT has captured interest worldwide, allowing people to experience AI firsthand, showing what’s possible with generative AI,” CEO Jensen Huang said on a Wednesday call with analysts. Earlier this year, Huang called the transformation an “iPhone moment” at a University of California, Berkeley, fireside chat.

Nvidia’s AI play is “accelerating in a way that will have disruptive implications” for both its competitors and “the world at large,” Rosenblatt Securities’ Hans Mosesmann said in a Wednesday note.

Nvidia’s report on the same day Intel slashed its dividend by two-thirds highlights a “multi-generational shift we have never witnessed,” Mosesmann continued, reiterating a buy rating and setting a $320 price target.

Credit Suisse’s Chris Caso offered a similarly optimistic note, calling Nvidia a stock “difficult not to own” and maintaining it as a sector top pick. That assessment, Caso wrote, was driven by “a combination of derisked gaming estimates coupled with what we believe is the strongest growth potential in semis from AI/datacenter.” Caso hiked Nvidia’s price target from $210 to $275.

And in an about-face, Goldman Sachs’ Toshiya Hari upgraded Nvidia to a buy rating and set a $275 price target. “In hindsight, we acknowledge that our decision to remain on the sidelines in anticipation of a pullback in the company’s fundamentals was wrong,” Hari wrote in a Thursday morning note, citing Nvidia’s “disciplined expense management” and accelerating AI adoption.

— CNBC’s Michael Bloom, Jordan Novet and Kif Leswing contributed to this report.

Correction: Chris Caso is an analyst at Credit Suisse. An earlier version misspelled his name. The note from Toshiya Hari of Goldman Sachs was from Thursday morning. An earlier version misstated the day.