Getty Images

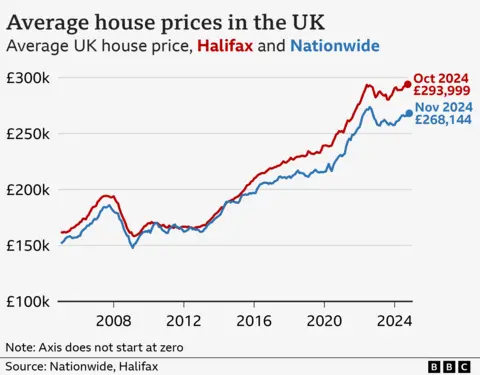

Getty ImagesHouse prices grew at the fastest annual pace for two years in November, according to the latest survey from Nationwide.

The lender said the price of a typical UK home rose by 3.7% last month compared to a year earlier, with property values close to a record high.

It said the acceleration in house price growth was “surprising, since affordability remains stretched by historic standards”.

Housing experts predict the market will see the number of sales increase over the next few months, ahead of changes to stamp duty due to take place in April.

House prices rose by 1.2% between October and November, Nationwide said, the biggest month-on-month increase since March 2022.

The average property now costs £268,144, according to the building society, close to the record high of £273,751 reached in August 2022.

Nationwide noted that the housing market had remained “relatively resilient” in recent months, with the number of mortgages approved at near pre-pandemic levels.

Mortgage approvals in October hit the highest monthly level since August 2022, according to Bank of England figures released last week.

Nationwide chief economist Robert Gardner said low levels of unemployment combined with pay increases that were outstripping inflation had helped to “underpin” the housing market.

Stamp duty

In the Budget in October, Chancellor Rachel Reeves said that reduced stamp duty rates in England and Northern Ireland would end in April next year.

Some housing market analysts said this announcement was behind the big rise in prices last month. However, Mr Gardner said it was “unlikely” this had been the case “since the majority of mortgage applications commenced before the Budget announcement”.

The changes will mean that house buyers will start paying stamp duty on properties over £125,000, instead of over £250,000 at the moment.

First-time buyers currently pay no stamp duty on homes up to £425,000, but this will drop to £300,000 in April.

Nationwide said it expected a jump in house sales in the first three months of 2025 as people tried to beat the deadline, followed by a decline in activity in the following few months.

Overall, Mr Gardner said he expected the housing market to strengthen gradually as consumers’ spending power was boosted by lower interest rates and higher pay.

However, Sarah Coles, head of personal finance at Hargreaves Lansdown, said that with prices near record highs and mortgage rates remaining “relatively high”, there was a “a growing chance that affordability raises its ugly head again”.

Mortgage rates

Mortgage rates started falling in the summer after the Bank of England began cutting its key interest rate.

However, mortgage rates have edged up in recent weeks on expectations that the Bank will not cut rates as quickly as had been previously expected.

In addition, there are still millions of people who are set to see their mortgage repayments increase over the next few years, as their current fixed-rate deals come to an end.

Last week, the Bank of England estimated that about 4.4 million mortgage holders are expected to see payments rise by 2027.

It said a typical owner-occupier coming off a fixed rate in the next two years would see their monthly mortgage repayments increase by around £146.

According to financial information website Moneyfacts, the average two-year fixed mortgage rate is currently 5.52%, while the average five-year fixed rate is 5.28%.

To get over the problem of mortgage affordability, an increasing number of homebuyers are taking out deals over longer-than-usual time periods.

Ultra-long, or extended, mortgages have become more popular as people aim to spread the cost of buying a house.

More than a million mortgages have been issued in the past three years which homebuyers are set to still be repaying into pension age.

However, while this can cut the size of monthly payments, it will ultimately make the loan more expensive, and experts say it can affect financial planning for retirement.