Getty Images

Getty ImagesFirms have “paused” hiring staff and are putting off investment decisions amid speculation of tax rises in the government’s upcoming Budget, a leading business group has warned.

Ben Jones, lead economist at the CBI, said some businesses had delayed decisions until they got “more clarity over the direction of the new government’s economic policies”.

The government will set out its tax and spending policies in the Budget on 30 October.

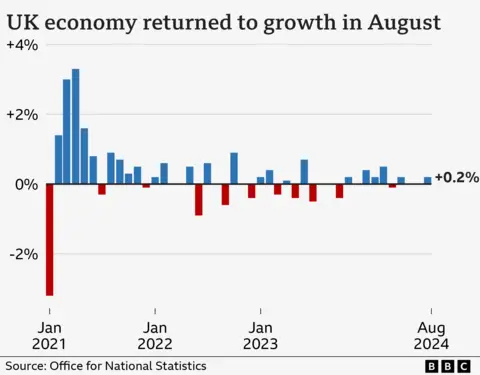

The CBI’s comments came as new figures showed the UK economy returned to growth in August, expanding by 0.2%.

The expansion – driven by a bounce-back in construction and a strong month for accountancy, manufacturers and retail businesses – came after the economy had failed to grow in June and July.

However, the Office for National Statistics (ONS) warned the UK’s outlook was one of weaker economic growth, despite the pick-up in August.

“The broader picture is one of slowing growth in recent months, compared to the first half of the year,” said Liz McKeown, director of economic statistics at the ONS.

Economists suggested businesses needed clarity over the government economic plans and industrial policies, with the UK hosting its International Investment Summit in London next week, where the ministers will try to attract billions of pounds of investment.

The CBI said the government, especially ahead of the Budget, had a chance to “build momentum” behind boosting economic growth by showing it “has a credible plan” to support business investment.

“Anecdotally it’s clear that some firms have paused hiring and investment decisions pending more clarity over the direction of the new government’s economic policies,” said Mr Jones, of the CBI, which says it represents 170,000 businesses.

“Our surveys suggest that businesses may have tapped the brakes again in September amid speculation over potential Budget announcements.”

Prime Minister Sir Keir Starmer has warned the Budget will be “painful”, with the government admitting some taxes will rise.

The Budget will be the government’s first big opportunity to set out its spending and taxation priorities, but it comes against a backdrop of higher debt following the pandemic, higher interest rates and inflation that has only recently returned to normal levels.

There is growing debate over what tax rises the Chancellor, Rachel Reeves, will announce given the government has promised not to increase the burden on “working people” and ruled out increasing VAT, National Insurance or income tax.

A hike in capital gains tax has been rumoured. This is charged on profits made from the sale of an asset that has increased in value, such as second homes. Other choices available to the chancellor include reducing the tax relief on pensions and raising fuel duty.

It is also unclear if Labour’s pledge on not raising National Insurance applies to the element of the tax paid by employers, after Sir Keir side-stepped a question from Conservative leader Rishi Sunak at Prime Minister’s Questions this week.

Adrian Hanrahan, managing director of chemicals exporter Robinson Brothers, said increasing National Insurance contributions for employers was “just another tax on companies”.

“I really feel like as a manufacturing company in this country we are a sitting duck for taxes, we can’t move any place therefore we are easy prey,” he told BBC Newsnight.

Mr Hanrahan also criticised parts of the government’s Employment Rights Bill, in particular the proposed lengths of probation periods.

“If this is a government of growth…this will not help us grow in any way in the future,” he said.

‘Shift the narrative’

Reeves is reported to be planning to change borrowing rules to free up billions of pounds more in spending for big projects in an attempt to boost the economy, but the move will not prevent her introducing further tax rises.

The chancellor said on Friday that growing the UK economy was the government’s top priority, “so we can fix the NHS, rebuild Britain, and make working people better off”.

Anna Leach, chief economist at the Institute of Directors, said the government could use its investment summit and the Budget to “shift the narrative” away from the country’s debt pile and instead focus on “building tomorrow’s economy”.

“That’s the key to sustainable public finances and higher living standards,” she said.

The ONS monitors GDP – or gross domestic product – on a monthly basis, but more attention is paid to the trend over three months. Weaker performance earlier in the summer meant growth of just 0.2% between June and August compared with the previous three months.

At the end of last year the UK fell into a shallow recession, with the economy contracting for two three-month periods in a row. Growth rebounded in the first half of 2024.

Ahead of Monday’s investment summit, the owner of Scottish Power – Spanish energy giant Iberdrola – announced plans on Friday to double its investment in the UK over the next four years from £12bn to £24bn.

Keith Anderson, chief executive of Scottish Power, told the BBC’s Today programme that the cash would be used to expand the UK’s electricity grid in order to connect more homes and businesses.

He said the main thing the company had asked for the government to do was to speed up the planning process in order to complete projects faster.

“If you make planning twice as fast, we will invest twice as much money, and that is what we are bringing forward today,” he said.

The government plans to almost entirely replace fossil fuels with clean and renewable energy from UK electricity production by 2030, though critics claim it is not achievable in the timeframe and will send bills higher.

People, mostly in rural areas, also have concerns over the construction of the pylons, cables and substations needed to transmit electricity around the country.

But Mr Anderson said the spike in energy bills in recent years was caused by gas prices being “volatile” and that switching to wind power would lead to bills falling “over a number of years”.