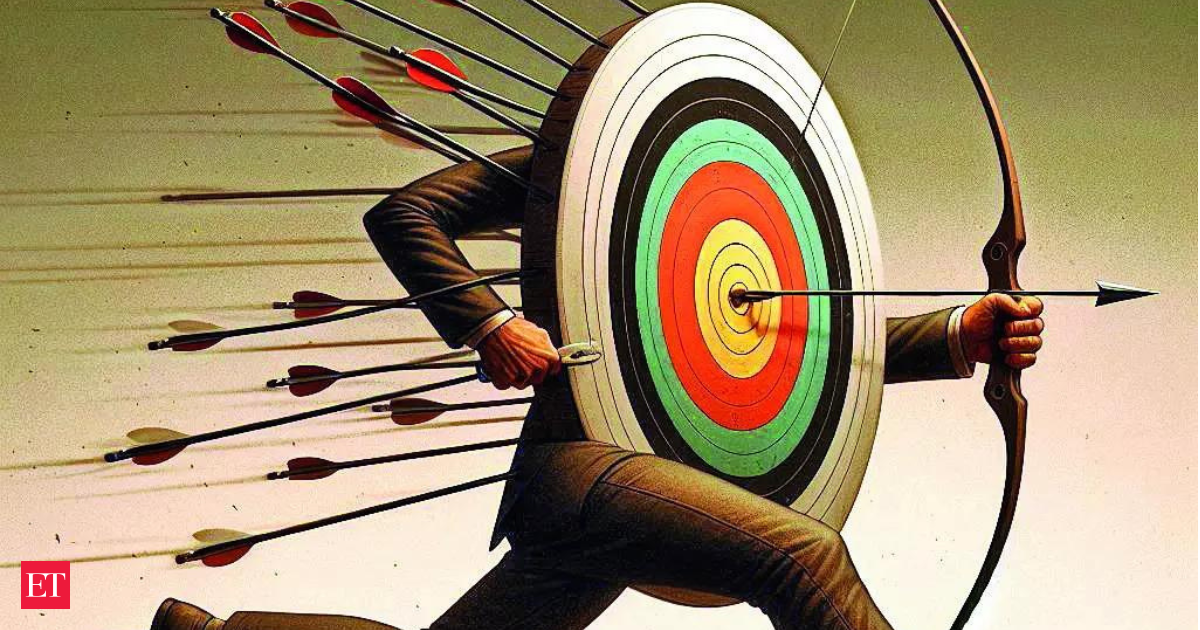

In her budget speech, Nirmala Sitharaman made an important declaration: ‘From 2026-27 onwards, we will aim to ensure that fiscal deficit each year keeps central government debt on a downward trajectory as a percentage of GDP.’ This marks a significant shift. It’s time to stop tilting at windmills; an obsession with fiscal deficit numbers alone can be dangerously misleading.

Targeting a specific fiscal deficit level often makes fiscal policy procyclical, meaning it amplifies economic fluctuations. During downturns, revenues fall and expenditures rise, but to meet the deficit target, GoI may be forced to cut spending or raise taxes, further weakening the economy. Conversely, increased revenues may lead to higher spending or tax cuts during upturns to prevent the deficit from shrinking, potentially overheating the economy. This approach undermines fiscal policy’s stabilising role, which should ideally counteract economic cycles rather than exacerbate them.

India’s shift towards rules-based fiscal policy began with the FRBM Act 2003, rooted in the 2000 Sarma committee recommendations. The act set ambitious targets, including reducing the fiscal deficit to 3% of GDP and eliminating the revenue deficit by 2008, aiming to enforce fiscal discipline through fixed numerical limits. However, these targets were revised multiple times due to macroeconomic challenges.

The fiscal policy framework has since evolved.

N K Singh-led FRBM Review Committee (2016) recommended using the general government debt-to-GDP ratio as a medium-term anchor, and introduced new fiscal deficit targets. 2018 amendments to the FRBM Act adopted these recommendations, incorporating flexible provisions like ‘escape’ and ‘buoyancy’ clauses, which allow deviations during exceptional circumstances, such as the pandemic.Tracking fiscal deficits involves challenges that complicate fiscal management. A critical issue lies in the divergence between debt increments and fiscal deficit. Theoretically, increase in public debt from one period to the next should correspond with fiscal deficit, adjusted for factors such as exchange rate fluctuations. However, this theoretical alignment is disrupted by the exclusion of certain debt receipts – like subscriptions to international organisations and recapitalisation of PSBs – from the fiscal deficit calculus. Moreover, use of off-budget financing mechanisms further obscures the fiscal deficit, leading to an underestimation of GoI’s true fiscal liabilities.

Technically, relying on GDP estimates as the denominator for calculating the fiscal deficit introduces substantial variability and complexity. GDP figures, which are revised multiple times during the fiscal year, result in a dynamic and shifting fiscal target, complicating budget execution. This variability necessitates frequent adjustments in government expenditures, undermining fiscal stability and consistency.

Such a framework contradicts the principles of sound fiscal policy, as it forces GoI to respond to changing GDP estimates rather than adhering to a stable fiscal strategy. The resulting last-minute adjustments, such as deferring tax refunds to meet revised deficit targets, distort fiscal transparency and accountability.

Why is a debt-to-GDP ratio a better indicator of fiscal responsibility?

It’s a more reliable measure of fiscal performance because it captures the cumulative effect of fiscal decisions over time, rather than focusing solely on the current fiscal stance. Literature supports the view that this metric offers a broader perspective by incorporating the historical trajectory of a country’s fiscal policy.

Unlike deficit, which only reflects the balance between revenue and expenditure in a given year, debt-to-GDP encompasses all past decisions, including off-balance-sheet liabilities and contingent obligations. This broader scope reduces the scope for ‘hidden’ deficits, as it includes items that might not appear in the annual deficit, but still contribute to the nation’s overall debt burden.

Debt-to-GDP provides a more comprehensive and accurate picture of a country’s fiscal health, aligning with the arguments made by economists like Carmen Reinhart and Kenneth Rogoff, who, in 2010, emphasised the importance of considering long-term fiscal sustainability when assessing economic performance.

Debt-to-GDP ratio compares a country’s debt with its productive capacity, sending policymakers more appropriate and incentive-compatible signals. When a government incurs a deficit during a period of economic slack and directs this spending towards growth-inducing capex, the resulting higher debt may lead to enhanced economic growth and productivity, ultimately improving the debt-to-GDP ratio in the long run.

This aligns with Keynesian economic theory, which advocates countercyclical fiscal policies to stimulate demand during downturns. However, if policymakers were to focus solely on the annual deficit, they might be dissuaded from engaging in such productive expenditures due to the immediate impact on the deficit figure.

This could lead to suboptimal fiscal policies, prioritising short-term fiscal targets over long-term economic growth. Debt-to-GDP offers a more robust and growth-oriented measure of fiscal performance. Thus, embracing it shifts us toward a more realistic and sustainable fiscal path, capturing the broader impacts of economic decisions. It’s a move away from the quixotic chase of rigid deficit targets – no longer tilting at windmills, but steering with clarity toward genuine fiscal health.

Debroy is chairman, and Sinha is OSD, research, EAC-PM