CrowdStrike IPO at the Nasdaq exchange June 12, 2019.

Source: Nasdaq

Economic concerns were a major theme across the technology industry during second-quarter earnings season, as companies cautioned about slower spending on ads, gadgets, e-commerce and software.

But with interest rates rising and inflation stuck near a 40-year high, one part of the tech sector is still showing booming demand: cybersecurity.

Earnings reports this week from CrowdStrike and SentinelOne pleasantly surprised Wall Street, and both companies, which specialize in protecting the many devices attached to corporate networks, boosted their forecasts for the year.

“Cybersecurity is not a discretionary line item,” CrowdStrike CEO George Kurtz said on his company’s earnings call.

Investors heard similar commentary last week from Palo Alto Networks, which reported a profit for the first time in a decade. The data center security company’s stock soared 12%, its best performance since its IPO in 2012.

And two weeks ago, Cisco said its security business grew faster than all other segments, surpassing analysts’ estimates by about $100 million. Security is now Cisco’s top investment area, CEO Chuck Robbins told analysts on a conference call, and the company is staffing up as it raises prices to counter higher costs of components it needs to assemble hardware.

Across the security landscape, vendors are busy providing tools to big companies concerned about vulnerabilities that have emerged due to the remote work and hybrid phenomenon and an increase in cyber attacks lodged while Russia is at war in Ukraine.

“In transformational projects, the vast majority of our customers continue on their investments here, despite the expected short-term macro impacts,” Nikesh Arora, CEO of Palo Alto Networks, said on the call with analysts. “Security spending is tied into our customers’ desires to move to the cloud, drive more direct relationship with their customers, modernize their IT infrastructure, as well as drive efficiencies while adapting to a new way of working. Those efforts continue.”

Investors haven’t made money on the security bet this year, but they’ve lost less than if they’d wagered on the broader tech market.

Cyber-focused exchange-traded funds from First Trust Nasdaq and Global X (ticker symbol BUG) are down 22% and 19%, respectively, in 2022. The Nasdaq has dropped 25% for the year.

Cyber stocks vs. Nasdaq

CNBC

Within software, security providers are showing the advantage they enjoy during a period of economic turmoil. Clients can’t reduce their spending given the myriad of threats they face and the risks to their business if they’re hit with a big ransomware attack. So they’re looking elsewhere.

Last week, cloud-software maker Salesforce trimmed its fiscal-year guidance and said customers had become more deliberate about purchases. The stock slid 11% over the next three trading sessions. Shares of Zoom also tumbled after the video-calling software company reduced its projections for the full year.

Elsewhere in technology, ad-supported businesses like Snap and Facebook have gotten pummeled, while online commerce companies Shopify and Affirm warned of a return to pre-Covid spending patterns. Even Apple CEO Tim Cook said the iPhone marker sees “pockets of softness” as fears of an economic slowdown percolate.

“I don’t know that anybody’s using the recession word,” said Gary Steele, CEO of Splunk, whose software helps companies analyze data to monitor performance and spot threats, in an interview this week. “I just think that we saw macro conditions where budgets seemed to be tightening, meaning they had to make a decision about when they wanted something to happen.”

Second-quarter revenue at CrowdStrike rose 58% from a year earlier as the company signed up over 1,700 subscribing clients, more than in any previous quarter. Burt Podbere, CrowdStrike’s finance chief, said the company was enjoying “strong industry tailwinds.”

Kurtz told analysts that it’s taking longer to do some deals because clients are being forced to get higher levels of required approvals before making purchases. But they’re still happening. Jefferies was one of several banks to raise its price target on CrowdStrike, and analysts at the firm said the company should be reasonably sheltered in the case of a recession.

SentinelOne CEO Tomer Weingarten touted his company’s record-high gross margin and customer retention rate.

“Cybersecurity remains a top priority for enterprise IT spending, a must-buy for all enterprises,” he said.

Palo Alto’s Arora said clients signed up for long-term deals during the quarter. That lines up with commentary from Guggenheim analysts, who wrote in a note to clients that security spending among companies they cover hasn’t moderated as much as IT spending.

Not all companies in the space are seeing a pop.

Okta shares tumbled 33% on Thursday, after the provider of secure sign-on software cited a “weakening economy” and said it was struggling to integrate salespeople from Auth0, which it acquired last year for $6.5 billion.

“Integrations are always difficult and touch every part of an organization,” CEO Todd McKinnon said on the earnings call. “While we are making progress, we’ve experienced heightened attrition within the go-to-market organization, as well as some confusion in the field, both of which have impacted our business momentum.”

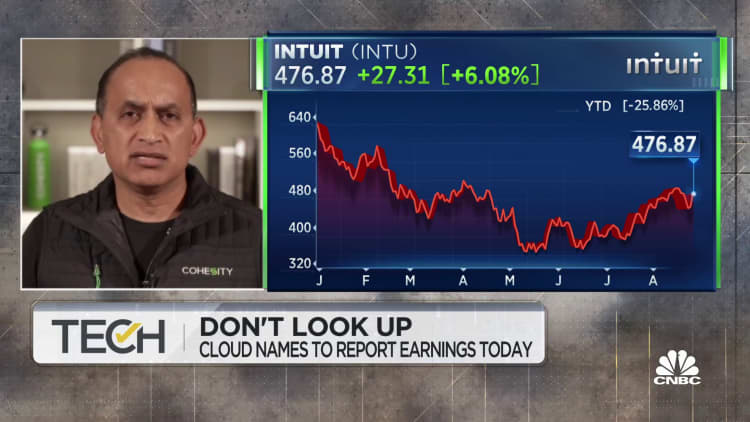

WATCH: Security and data are strong trends in small cloud companies, says Cohesity CEO Sanjay Poonen