By Lora Jones, Daniele Palumbo & David Brown

BBC News

The coronavirus pandemic has reached almost every country in the world.

Its spread has left national economies and businesses counting the costs, as governments struggle with new lockdown measures to tackle the spread of the virus.

Despite the development of new vaccines, many are still wondering what recovery could look like.

Here is a selection of charts and maps to help you understand the economic impact of the virus so far.

Global shares in flux

Big shifts in stock markets, where shares in companies are bought and sold, can affect the value of pensions or individual savings accounts (Isas).

The FTSE, Dow Jones Industrial Average and the Nikkei all saw huge falls as the number of Covid-19 cases grew in the first months of the crisis.

The major Asian and US stock markets have recovered following the announcement of the first vaccine in November, but the FTSE is still in negative territory.

The FTSE dropped 14.3% in 2020, its worst performance since 2008.

In response, central banks in many countries, including the UK, have slashed interest rates. That should, in theory, make borrowing cheaper and encourage spending to boost the economy.

Some markets recovered ground in January this year, but this is a normal tendency known as the “January effect”.

Analysts are worried that the possibility of further lockdowns and delays in vaccination programmes might trigger more market volatility this year.

A difficult year for job seekers

Many people have lost their jobs or seen their incomes cut.

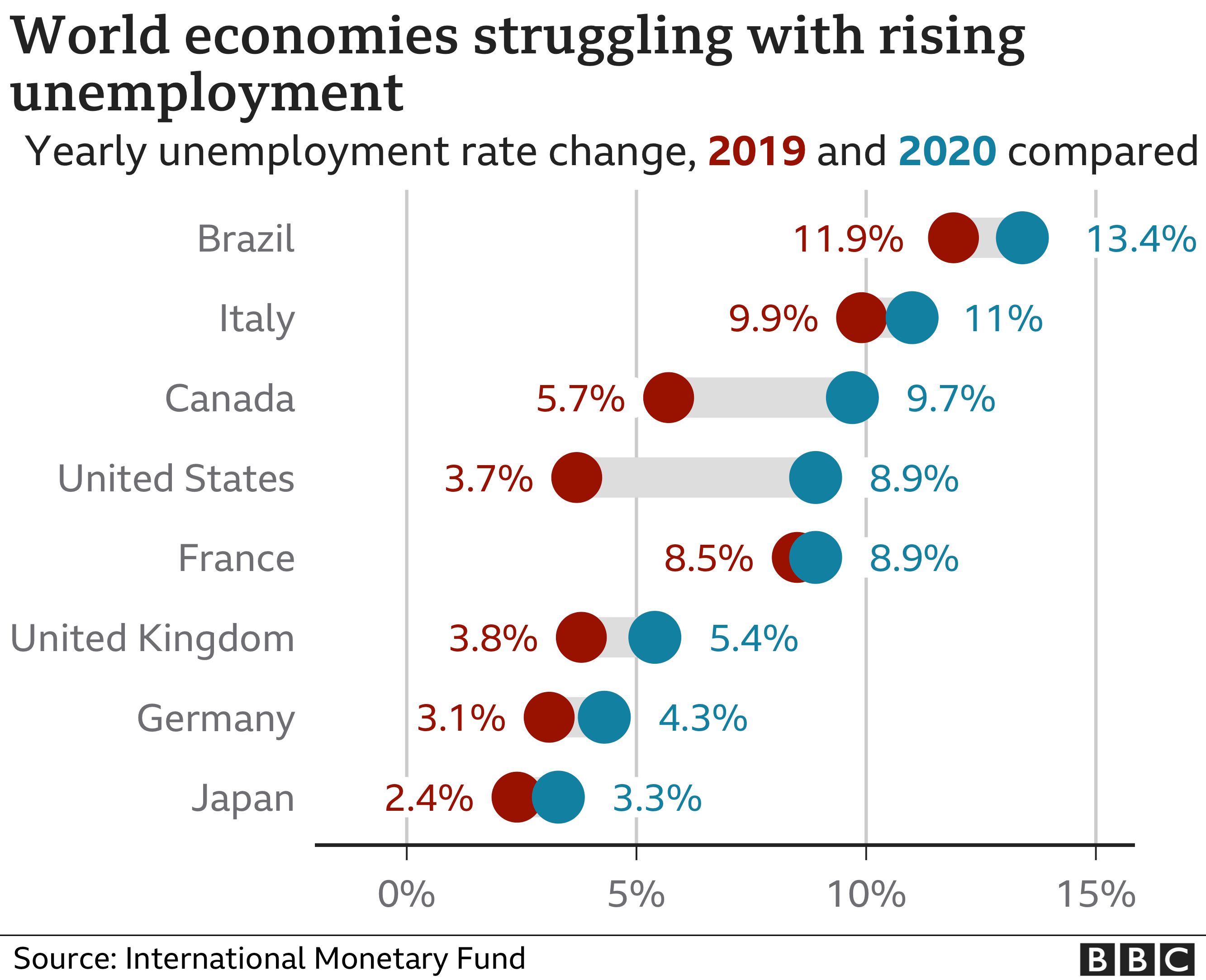

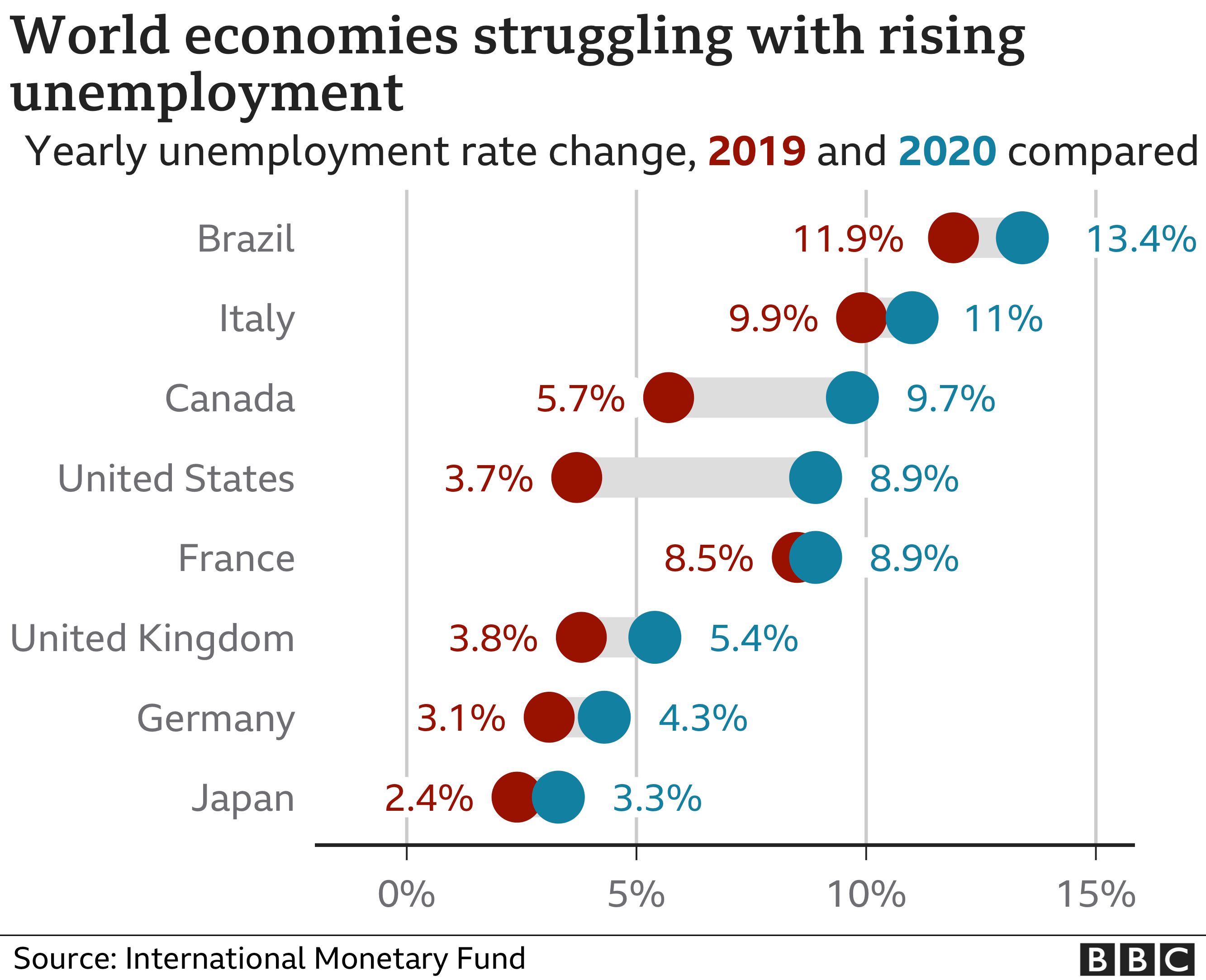

Unemployment rates have increased across major economies.

In the United States, the proportion of people out of work hit a yearly total of 8.9%, according to the International Monetary Fund (IMF), signalling an end to a decade of jobs expansion.

Millions of workers have also been put on government-supported job retention schemes as parts of the economy, such as tourism and hospitality, have come to a near standstill.

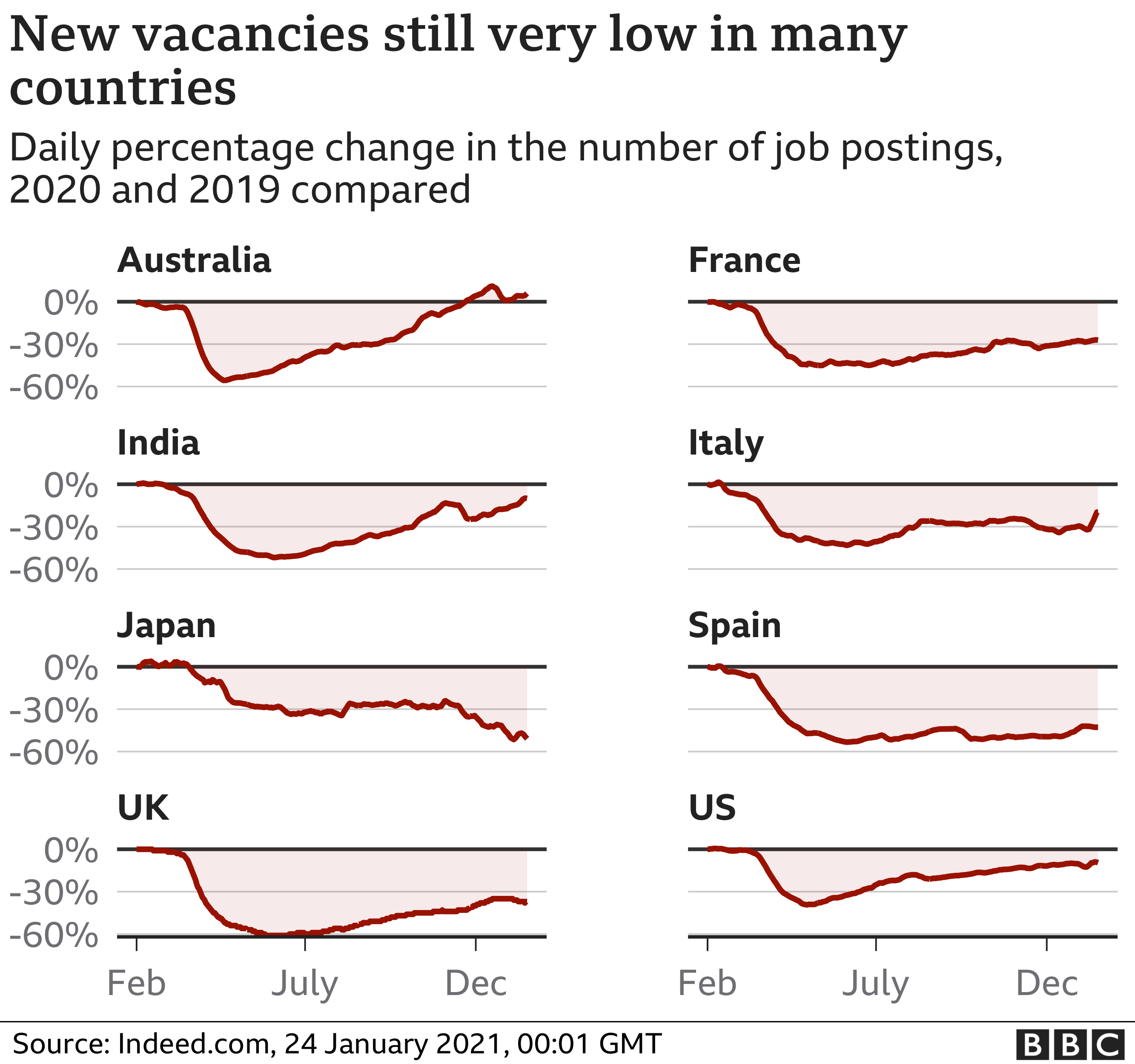

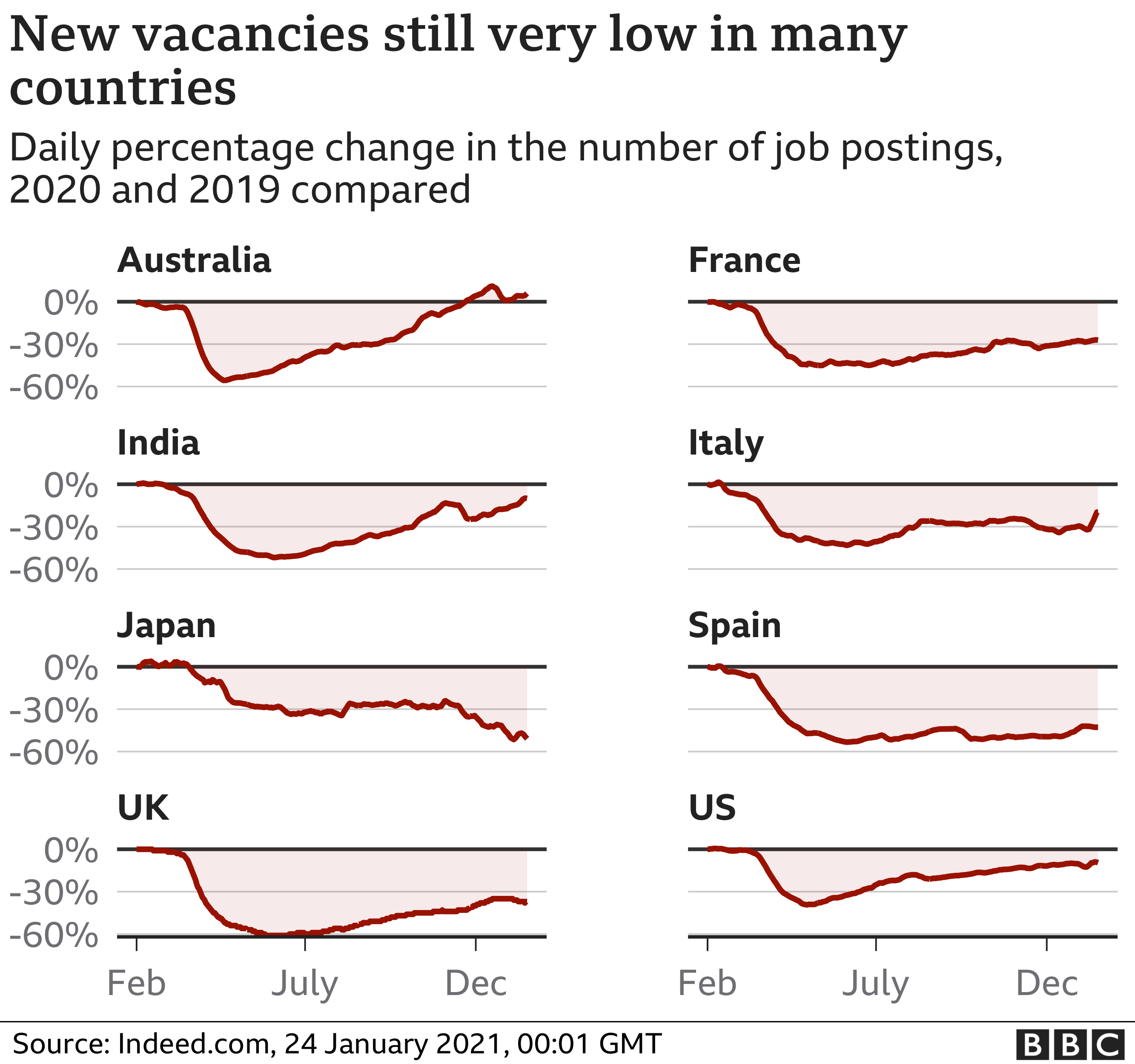

The numbers of new job opportunities is still very low in many countries.

Job vacancies in Australia have returned to the same level of 2019, but they are lagging in France, Spain, the UK and several other countries.

Some experts have warned it could be years before levels of employment return to those seen before the pandemic.

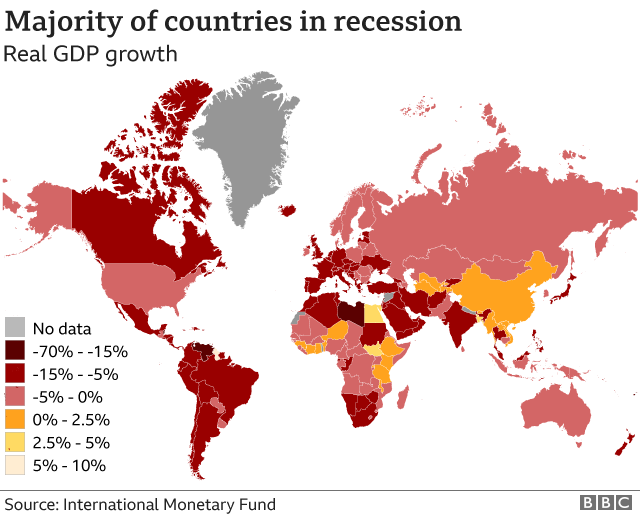

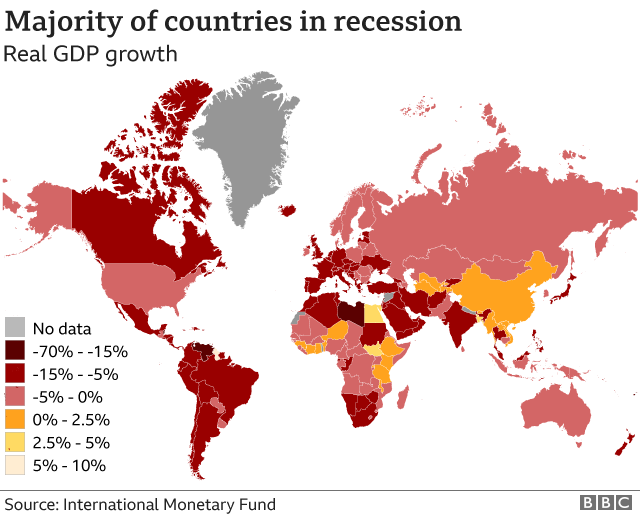

Most of countries now in recession

If the economy is growing, that generally means more wealth and more new jobs.

It’s measured by looking at the percentage change in gross domestic product, or the value of goods and services produced, typically over three months or a year.

The IMF estimates that the global economy shrunk by 4.4% in 2020. The organisation described the decline as the worst since the Great Depression of the 1930s.

The only major economy to grow in 2020 was China. It registered a growth of 2.3%.

The IMF is, however, predicting global growth of 5.2% in 2021.

That will be driven primarily by countries such as India and China, forecast to grow by 8.8% and 8.2% respectively.

Recovery in big, services-reliant, economies that have been hit hard by the outbreak, such as the UK or Italy, is expected to be slow.

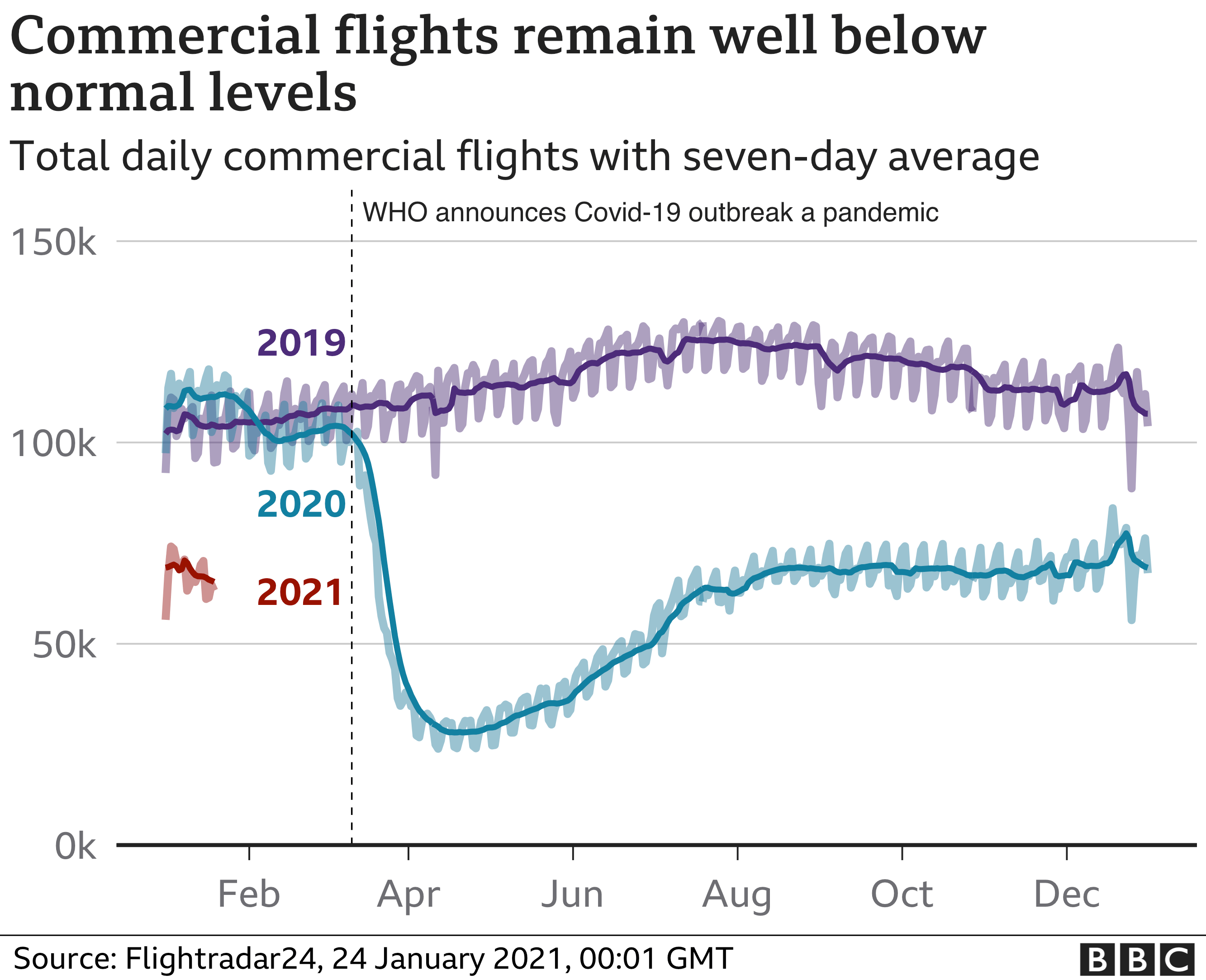

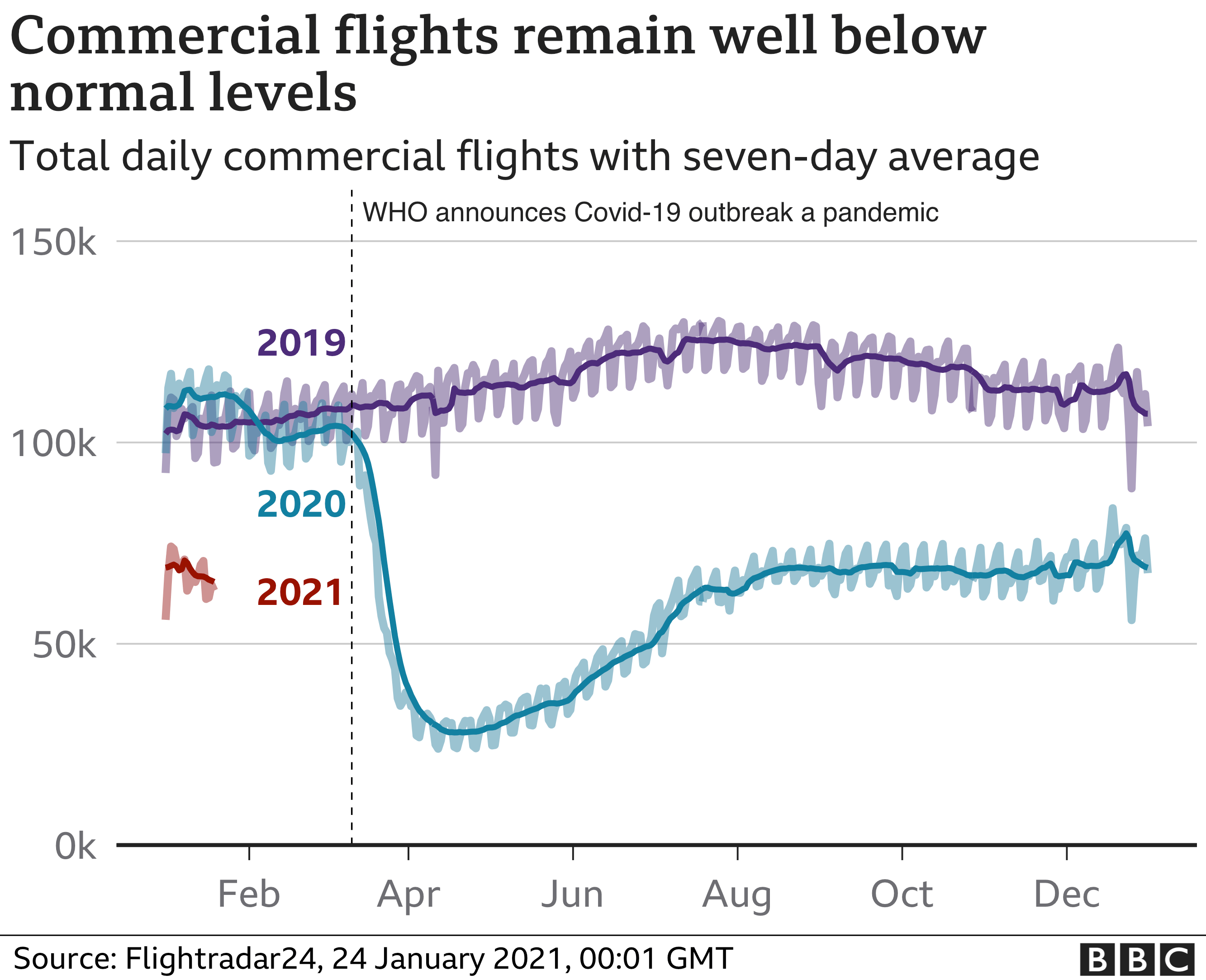

Travel still far from taking off

The travel industry has been badly damaged, with airlines cutting flights and customers cancelling business trips and holidays.

New variants of the virus – discovered only in recent months – have forced many countries to introduce tighter travel restrictions.

Data from the flight tracking service Flight Radar 24 shows that the number of flights globally took a huge hit in 2020 and it is still a long way from recovery.

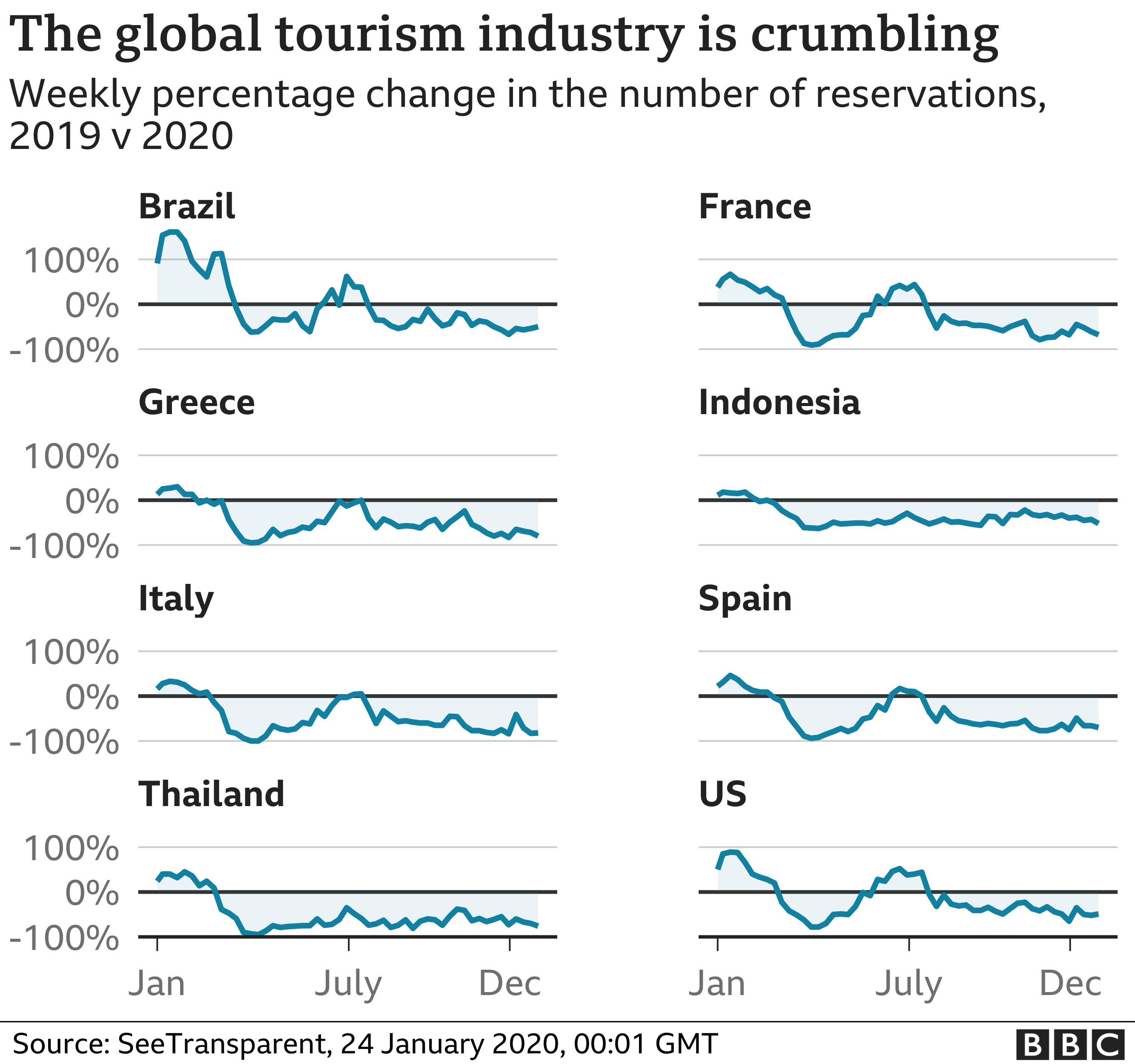

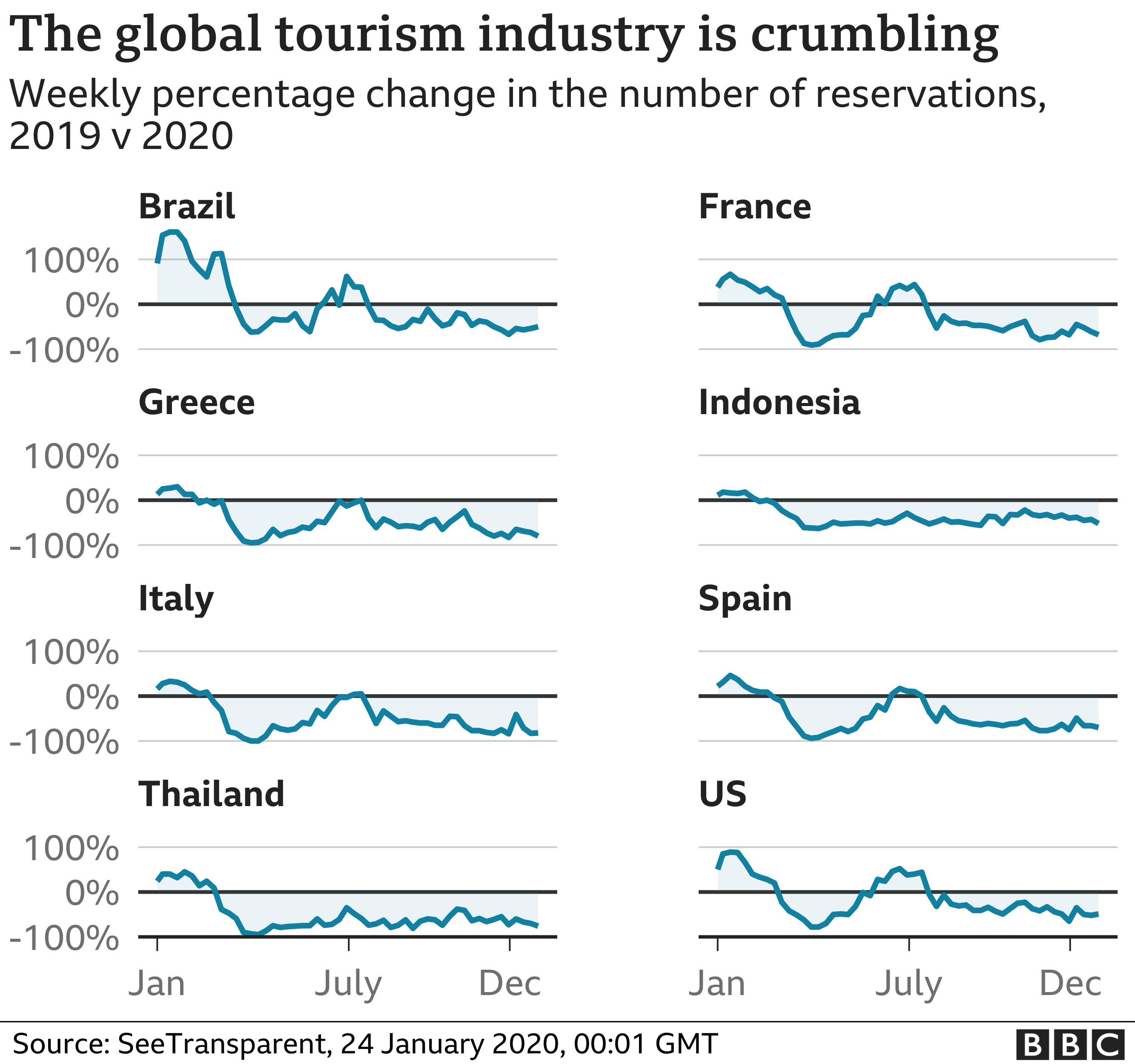

Hospitality sector has shut its doors worldwide

The hospitality sector has been hit hard, with millions of jobs and many companies bankrupt.

Data from Transparent – an industry-leading intelligence company that covers over 35 million hotel and rental listings worldwide – has registered a fall in reservations in all the top travel destinations.

Billions of dollars have been lost in 2020 and although the forecast for 2021 is better, many analysts believe that international travel and tourism won’t return to the normal pre-pandemic levels until around 2025.

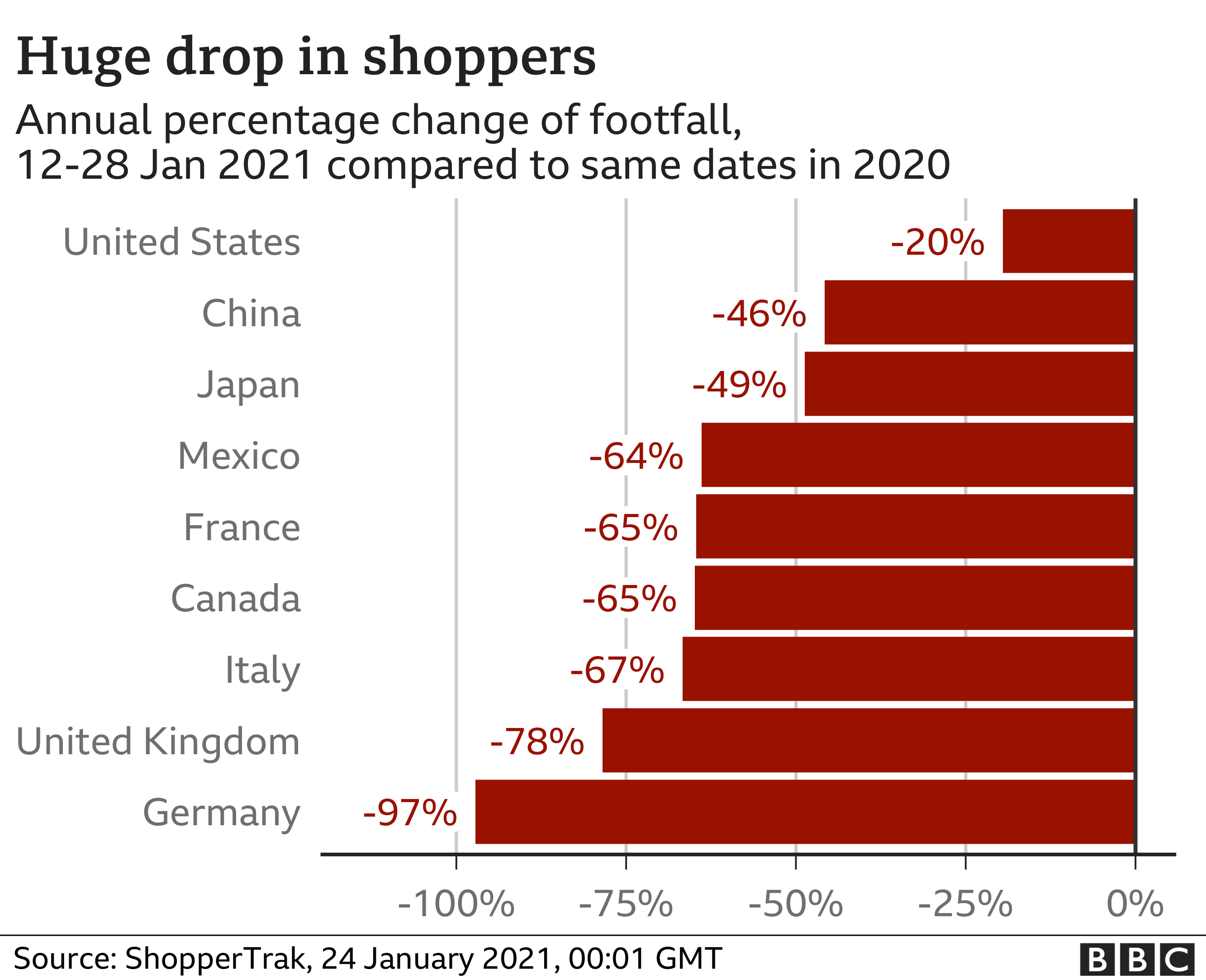

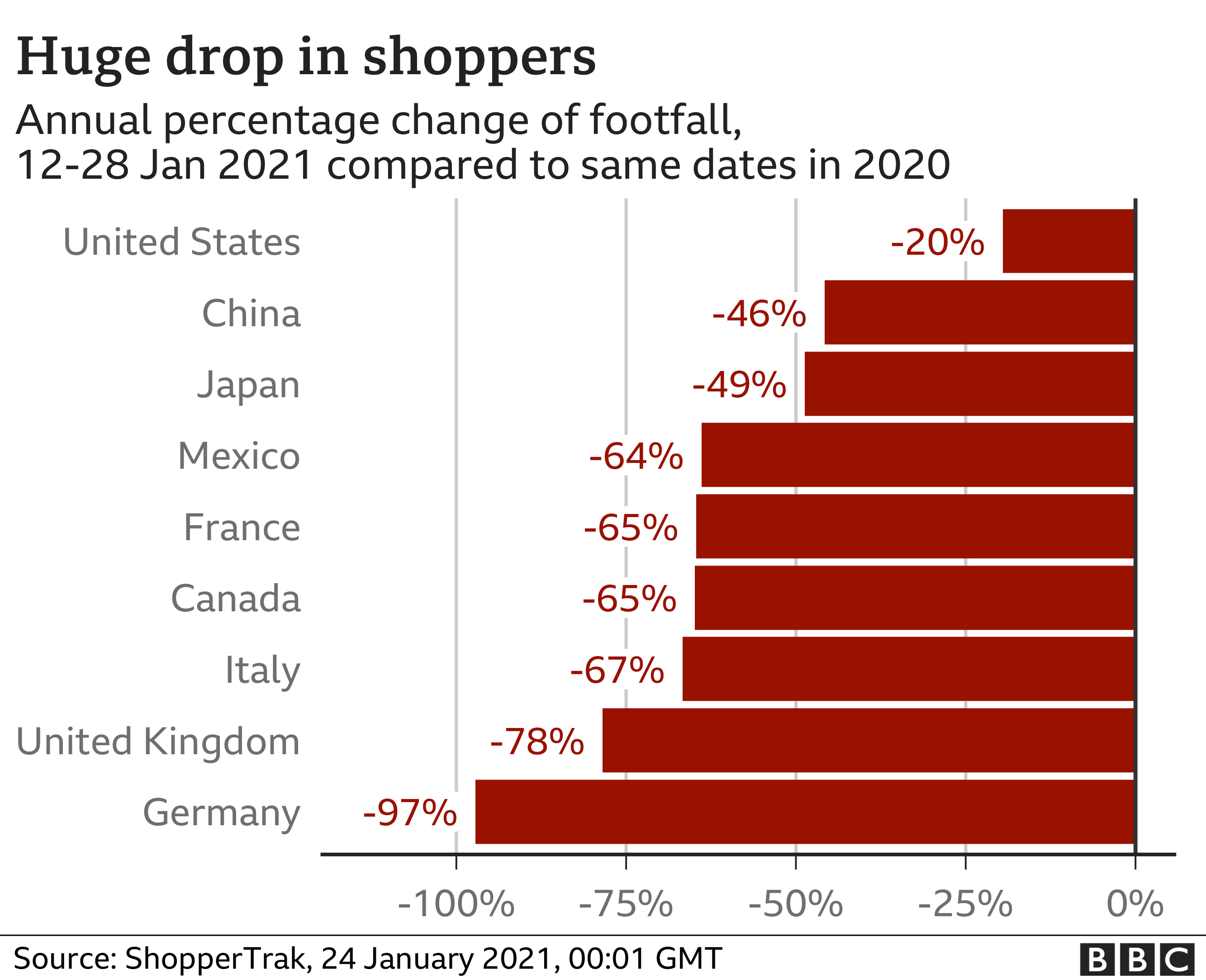

Shopping… at home

Retail footfall has seen unprecedented falls as shoppers stayed at home.

New variants and surges in cases have made problems worse.

Pedestrian numbers have fallen further from the first lockdown, according to research firm ShopperTrak,

Separate research suggests that consumers are still feeling anxious about their return to stores. Accountancy giant EY says 67% customers are now not willing to travel more than 5 kilometres for shopping.

This change in shopping behaviour has significantly boosted online retail, with a global revenue of $3.9 trillion in 2020.

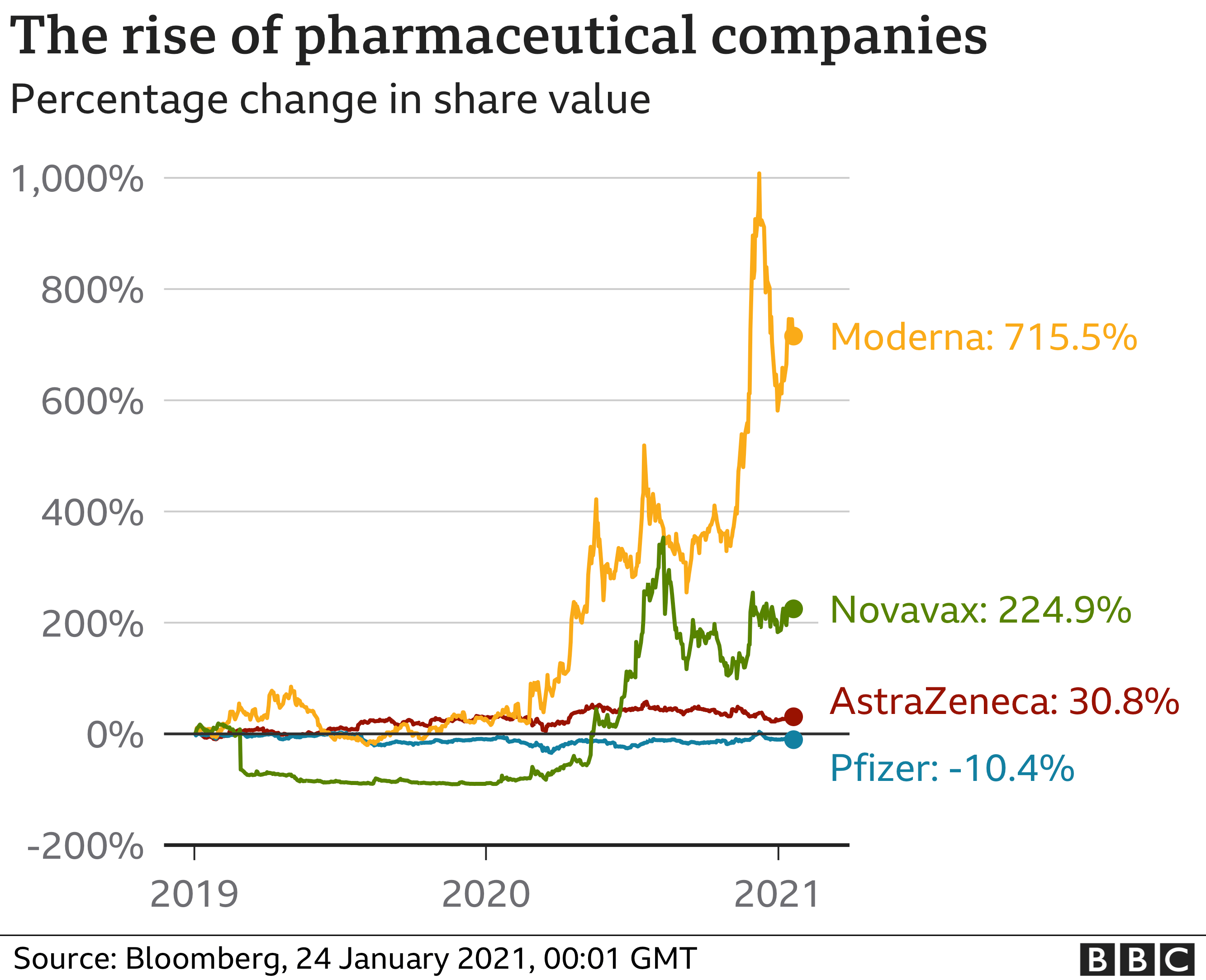

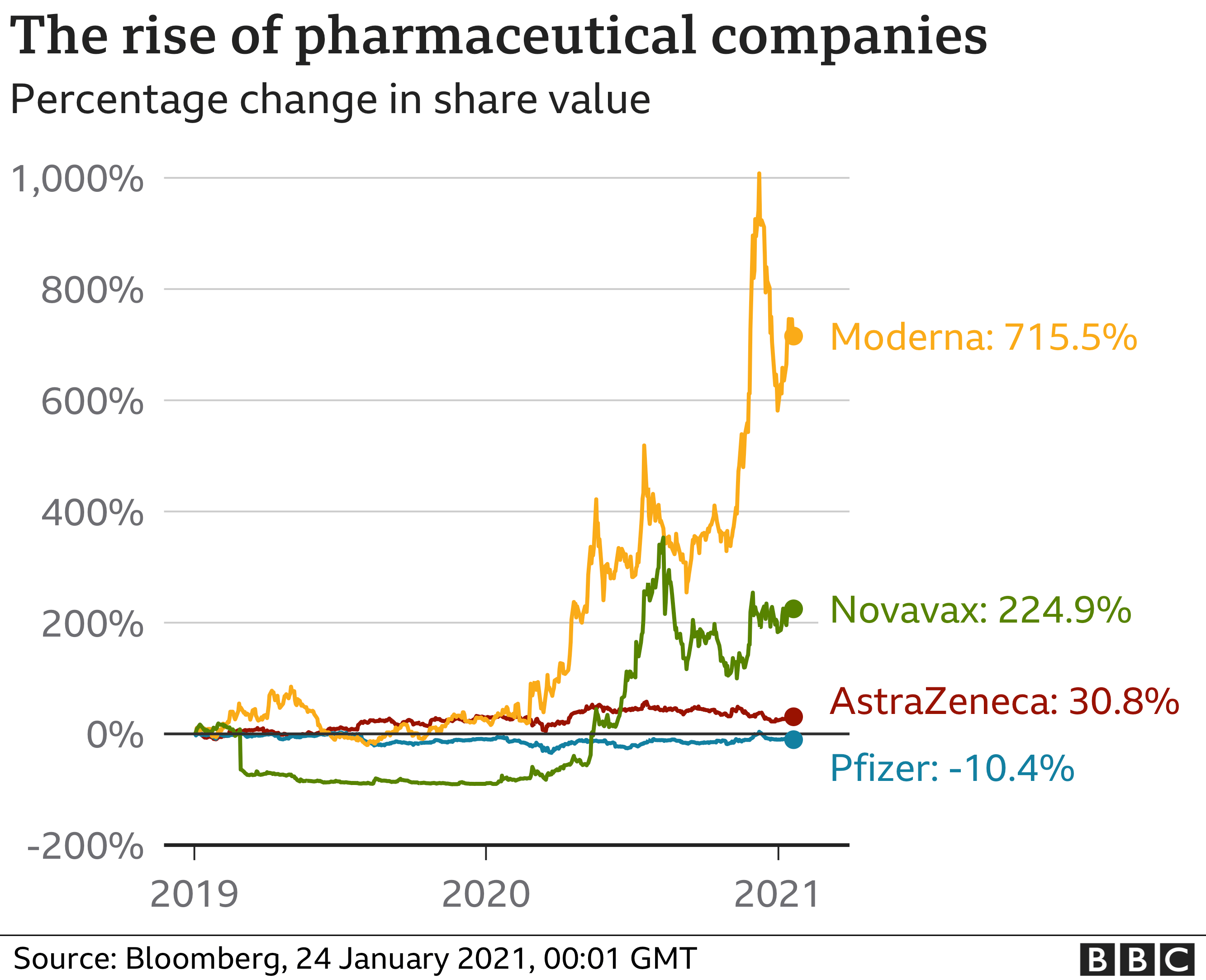

Pharmaceutical companies among the winners

Governments around the world have pledged billions of dollars for a Covid-19 vaccine and treatment options.

Shares in some pharmaceutical companies involved in vaccine development have shot up.

Moderna, Novavax and AstraZeneca have seen significant rises. But Pfizer has seen its share price fall. The partnership with BioNTech, the high cost of production and management of the vaccine, and the growing number of same-size competitors have reduced the investors’ trust in the company to have bigger revenue in 2021.

A number of pharmaceutical firms have started already distributing doses and many countries have started their vaccination programmes. Many more – such as Johnson & Johnson and Sanofi/GSK – will join the vaccine distribution during 2021.