Long-running act. Buffett and Munger in 2019.

ASSOCIATED PRESS

Warren Buffett and Charlie Munger revealed over the weekend that Greg Abel, the CEO of Berkshire Hathaway’s vast electric power generation business would be taking over from them some day. “The directors are in agreement that if something were to happen to me tonight it would be Greg who’d take over tomorrow morning,” Buffett said.

With that ended years of speculation on one of the closest kept secrets in finance. Abel, at 58, is a spring chicken compared with Buffett, 90, and Munger, 97. And he’s different in a another way: he’s not naturally a stock picker and asset allocator, rather he’s a business operator.

So don’t expect Abel to pick stocks (that role looks likely to remain with Todd Combs and Ted Weschler), but rather to keep building his energy businesses. Abel has already been instrumental in assembling a family of electric utilities that as a standalone company would be among the nation’s biggest, with 33,000 megawatts of generation, 21,000 miles of natural gas transmission lines and 5.2 million customers. And it’s an important cash generator, contributing $21 billion in revenues last year and $2.5 billion in pretax earnings.

“That dramatically changes the general character of what Berkshire Hathaway will be and what the investment motivation of owning it will be,” says Bill Smead of Smead Capital Management, which has held Berkshire shares for decades. “Warren has always kind of been the secret sauce,” he adds. Without him, “there just won’t be any magic attached to it.”

That said, Smead thinks the shift makes sense, because low interest rates and high equity valuations have left them “no fish in the barrel left for them to shoot” — with energy being somewhat of an exception. Regulated monopolies tend to be resistent both to recessions and to inflation. Plus, capital is in hot demand for heavily subsidized “decarbonization” investments. Last year Berkshire dropped $8 billion on Dominion Energy’s

D

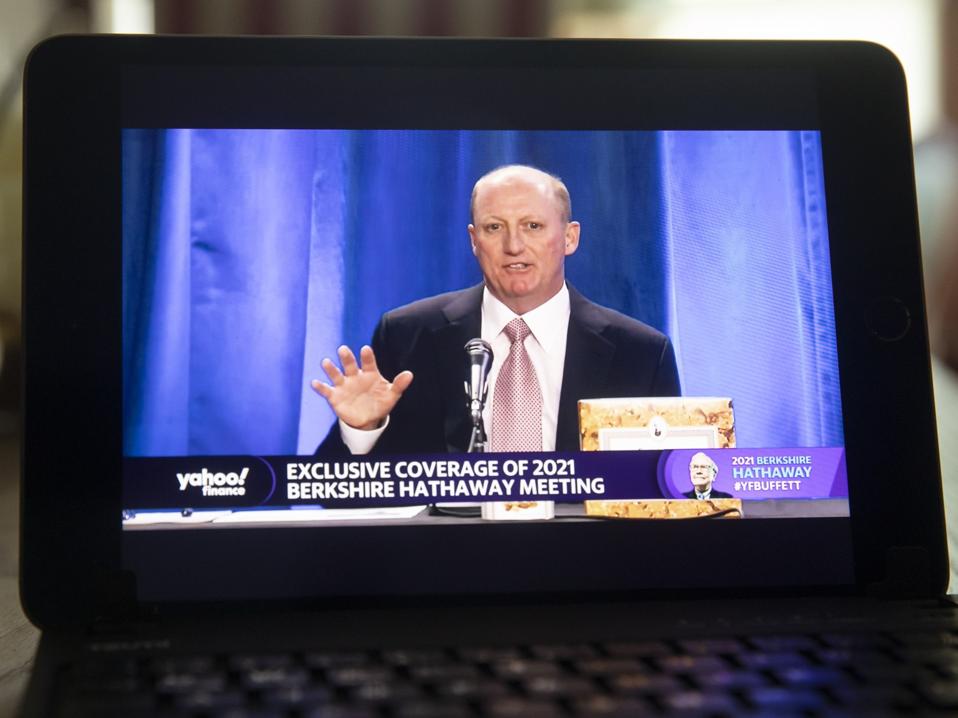

Speaking over the weekend, Abel said that the Texas power grid “fundamentally let the citizens down” in not being resilient enough to withstand the February deep freeze. “We’ve gone to Texas with what we believe is a good solution,” he said. “The health and welfare of Texas was at risk, and we needed to effectively have an insurance policy in place for them.”

Greg Abel, chairman of Berkshire Hathaway Energy Co., speaks during the virtual Berkshire Hathaway … [+]

© 2021 Bloomberg Finance LP

Abel was born in Edmonton, Alberta and graduated 1984 from the University of Alberta. He worked at accountancy PriceWaterhouseCoopers, then landed at geothermal company CalEnergy before joining MidAmerican Energy in 1992. Berkshire acquired the company for $2 billion in 2000 as part of Buffett’s initial rollup of electric utilities. In 2005 they bought Pacificorp from Scottish Power for $5.1 billion. In 2011 Abel replaced David Sokol as CEO of Berkshire Energy (after revelations that Sokol bought $10 million in Lubrizol

LZ

Buffett has called Abel an excellent deal maker. That’s in part because he knows when to walk away. In 2017 it looked as if Berkshire was set to acquire Texas electric distribution company Oncor for $9 billion. But the deal didn’t go through — Sempra swooped in with a $9.5 billion bid (plus the assumption of $9 billion in debt). Berkshire didn’t see the point in trying to top them — the would point of the deal had been to Oncor at a good price.

In 2018 Abel was appointed Berkshire vice chairman, alongside Ajit Jain, 69, head of insurance operations. Both have “Berkshire in their blood,” Buffett said at the time. “He’s a first-class human being,” Buffett said about Abel in a 2013 video. “There’s a lot of smart people in this world, but some of them do some very dumb things. He’s a smart guy who will never do a dumb thing.”

In the first quarter of 2021 Berkshire’s energy business delivered $703 million in net earnings compared with $561 million a year ago. Abel has reduced Berkshire’s coal-fired power generation by nearly half in recent years.

Investor Smead predicts that Abel and Berkshire will be very patient in looking for acquisitions, likely waiting for interest rates to go up a couple hundred basis points, which could loosen up market values.

The timing might not be right for Berkshire to make a big electric company acquisition right now — but that doesn’t necessarily mean you have to wait. Tim Porter, chief investment officer at Reaves Asset Management, thinks there are ample opportunities for regulated utilities to generate outsized returns by investing for “decarbonization” into wind, solar and batteries. “The grid is old and will need a lot of investment to accomodate new power,” says Porter, whose favorites include Wisconsin’s WEC Energy

WEC

XEL

LNT

AEE

Berkshire Hathaway meanwhile traded at $421,000 today, at 25 times expected 2021 earnings. Shares are up 60% in one year.

/https://specials-images.forbesimg.com/imageserve/60905753d8d9ee7639b3340b/0x0.jpg)