Watch: Hunt announces that energy support will continue

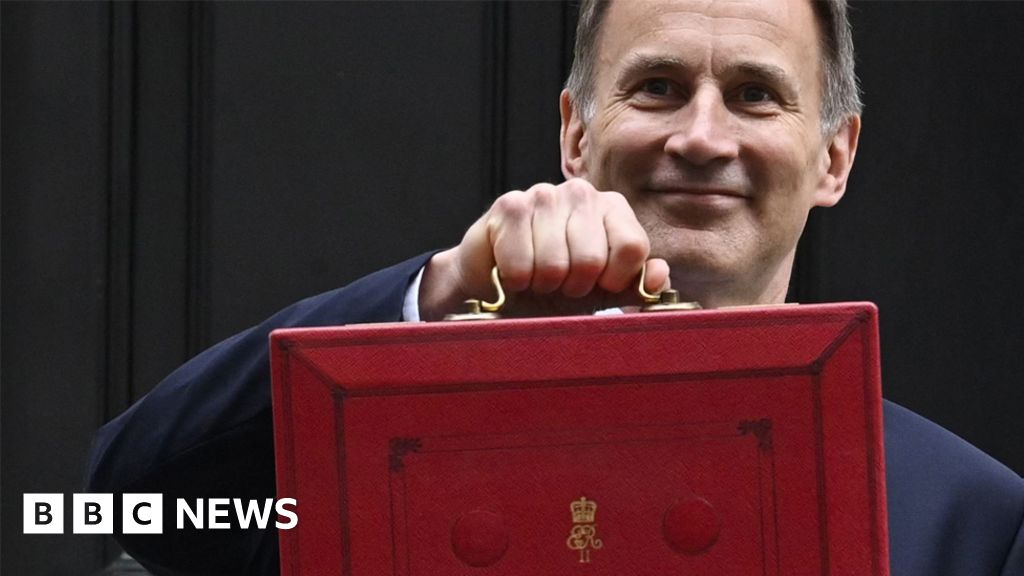

Chancellor Jeremy Hunt has unveiled the contents of his first Budget in the House of Commons.

It had a focus on prompting those who have left their jobs to return to the workforce, and boosting business investment.

Here is a summary of the main announcements.

Fuel, alcohol, pensions and wages

Energy bills, prepayment meter and nuclear power

- Government subsidies limiting typical household energy bills to £2,500 a year extended for three months, until the end of June

- £200m to bring energy charges for prepayment meters into line with prices for customers paying by direct debit – affects 4m households

- Commitment to invest £20bn over next two decades on low-carbon energy projects, with a focus on carbon capture and storage

- Nuclear energy to be classed as environmentally sustainable for investment purposes, with promise of more public funding

- £63m to help leisure centres with rising swimming pool heating costs, and invest to become more energy efficient

Childcare, universal credit and back to work plans

- 30 hours of free childcare for working parents in England expanded to cover one and two-year-olds, to be rolled out in stages from April 2024

- Families on universal credit to receive childcare support up front instead of in arrears, with the £646-a-month per child cap raised to £951

- £600 “incentive payments” for those becoming childminders, and relaxed rules in England to let childminders look after more children

- New fitness-to-work testing regime to qualify for health-related benefits

- New voluntary employment scheme for disabled people in England and Wales, called Universal Support

- Tougher requirements to look for work and increased job support for lead child carers on universal credit

- £63m for programmes to encourage retirees over 50 back to work, “returnerships” and skills boot camps

- Immigration rules to be relaxed for five roles in construction sector, to ease labour shortages

Government debt, inflation and economic growth

- Office for Budget Responsibility predicts the UK will avoid recession in 2023, but the economy will shrink by 0.2%

- Growth of 1.8% predicted for next year, with 2.5% in 2025 and 2.1% in 2026

- UK’s inflation rate predicted to fall to 2.9% by the end of this year, down from 10.7% in the last three months of 2022

- Underlying debt forecast to be 92.4% of GDP this year, rising to 93.7% in 2024

Corporation tax, Investment Zones and tax breaks

- Main rate of corporation tax, paid by businesses on taxable profits over £250,000, confirmed to increase from 19% to 25%

- Companies with profits between £50,000 and £250,000 to pay between 19% and 25%

- Companies able to deduct investment in new machinery and technology to lower their taxable profits

- Tax breaks and other benefits for 12 new Investment Zones across the UK, funded by £80m each over the next five years

- Reduced paperwork for international traders, who will also be given longer to submit customs forms under streamlined rules

Other measures

- Commitment to raise defence spending by £11bn over the next five years

- Prison sentences for those convicted of marketing tax avoidance schemes

- £200m this year to help local councils in England repair potholes

- An extra £10m over next two years for charities in England helping to prevent suicide

- Streamlined approvals process promised for new medical products

- £900m for new super computer facility, to help UK’s AI industry

What questions do you have about the Budget? You can get in touch by emailing haveyoursay@bbc.co.uk.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

If you are reading this page and can’t see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk. Please include your name, age and location with any submission.